Singapore Airlines 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 118 Annual Report 2006-07

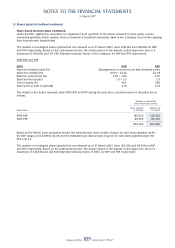

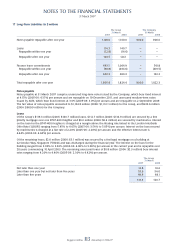

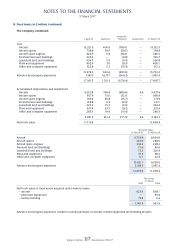

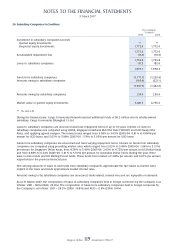

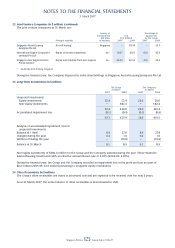

18 Fixed Assets (in $ million) (continued)

Assets pledged as security

In addition to assets held under fi nance leases, the following assets are mortgaged under bank loans:

The Group

31 March

2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net book value of:

– aircraft 199.3 213.7

– building – 5.4

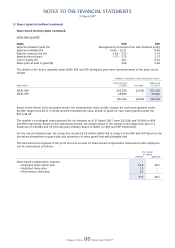

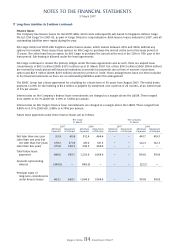

19 Intangible Assets (in $ million)

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Goodwill arising on consolidation 1.3 1.3 – –

Computer software 98.9 120.4 67.0 77.2

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

100.2 121.7 67.0 77.2

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

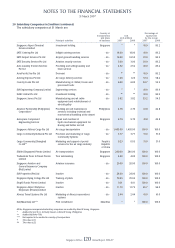

In 2002-03, SATS acquired 66.7% equity interest in Country Foods Pte Ltd at a cost of $6.0 million. Goodwill on

acquisition of $1.5 million was capitalised and amortised in fi nancial years 2003-04 ($0.1 million) and 2004-05

($0.1 million).

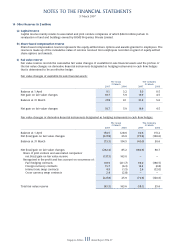

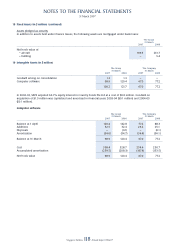

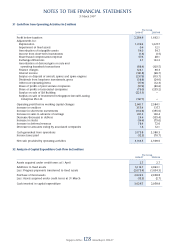

Computer software

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 120.4 142.8 77.2 88.3

Additions 32.5 32.4 26.2 25.1

Disposals – (0.1) – (0.1)

Amortisation (54.0) (54.7) (36.4) (36.1)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 98.9 120.4 67.0 77.2

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Cost 358.4 328.7 254.6 230.7

Accumulated amortisation (259.5) (208.3) (187.6) (153.5)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net book value 98.9 120.4 67.0 77.2

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––