Singapore Airlines 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 129 Annual Report 2006-07

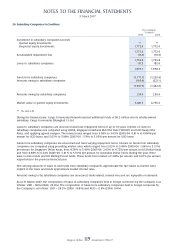

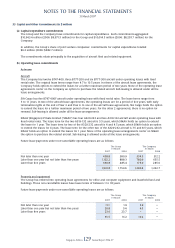

33 Capital and Other Commitments (in $ million)

(a) Capital expenditure commitments

The Group and the Company have commitments for capital expenditures. Such commitments aggregated

$10,963.6 million (2006: $8,971.5 million) for the Group and $10,014.5 million (2006: $8,205.7 million) for the

Company.

In addition, the Group’s share of joint venture companies’ commitments for capital expenditures totalled

$6.2 million (2006: $682.7 million).

The commitments relate principally to the acquisition of aircraft fl eet and related equipment.

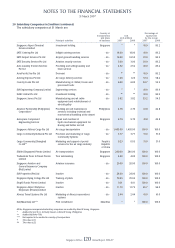

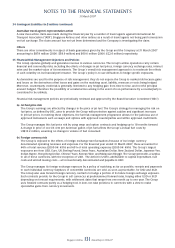

(b) Operating lease commitments

As lessee

Aircraft

The Company has twelve B747-400, three B777-200 and six B777-300 aircraft under operating leases with fi xed

rental rates. The original lease terms range from 4.7 to 10.5 years. In eleven of the aircraft lease agreements, the

Company holds options to extend the leases for a further maximum period of two years. None of the operating lease

agreements confer on the Company an option to purchase the related aircraft. Sub-leasing is allowed under all the

lease arrangements.

SIA Cargo has fi ve B747-400F aircraft under operating lease with fi xed rental rates. The lease terms range from

5 to 11 years. In two of the aircraft lease agreements, the operating leases are for a period of fi ve years, with early

termination rights at the end of Year 3 and Year 4. In one of the aircraft lease agreements, SIA Cargo holds the option

to extend the lease for a further maximum period of two years. For the other 2 agreements, there is no option for

renewal. Sub-leasing is allowed under all the lease arrangements.

SilkAir (Singapore) Private Limited (“SilkAir”) has four A320-232 and two A319-132 aircraft under operating lease with

fi xed rental rates. The lease term for the two A319-132 aircraft is 5.5 years, which SilkAir holds an option to extend

the lease for 1 year. The lease term for two of the A320-232 aircraft is 4 and 4.5 years, which SilkAir holds an option

to extend the leases for 4 years. The lease term for the other two of the A320-232 aircraft is 7.5 and 8.5 years, which

SilkAir holds an option to extend the leases for 1 year. None of the operating lease arrangements confer on SilkAir

the option to purchase the related aircraft. Sub-leasing is allowed under all the lease arrangements.

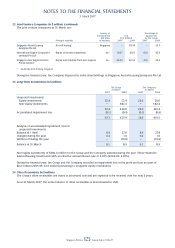

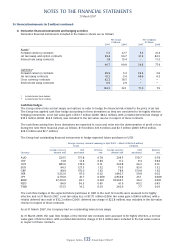

Future lease payments under non-cancellable operating leases are as follows:

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Not later than one year 438.8 380.9 334.5 312.2

Later than one year but not later than fi ve years 1,102.2 888.3 780.9 635.5

Later than fi ve years 360.8 485.4 175.0 285.0

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

1,901.8 1,754.6 1,290.4 1,232.7

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

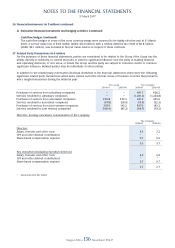

Property and equipment

The Group has entered into operating lease agreements for offi ce and computer equipment and leasehold land and

buildings. These non-cancellable leases have lease terms of between 1 to 18 years.

Future lease payments under non-cancellable operating leases are as follows:

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Not later than one year 11.1 1.9 3.9 –

Later than one year but not later than fi ve years 20.8 5.6 6.3 –

Later than fi ve years 23.6 23.7 – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

55.5 31.2 10.2 –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––