Singapore Airlines 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines 63 Annual Report 2006-07

Performance of Subsidiary Companies (continued)

Singapore Airlines Cargo (continued)

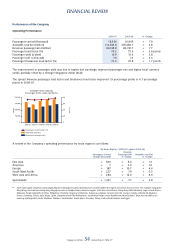

Yield declined 0.5 per cent while unit cost rose by 4.3 per cent in 2006-07. Freight traffi c (in load tonne kilometres) grew at

a modest rate of 1.5 per cent on capacity growth (in capacity tonne kilometres) of 4.1 per cent, which resulted in a lower

overall load factor by 1.6 percentage points to 62.0 per cent.

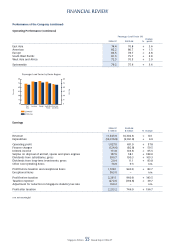

As a result, SIA Cargo incurred an operating loss of $32 million in 2006-07, compared to an operating profi t of $174 million

in the previous fi nancial year. However, a net profi t after taxation of $31 million was recorded, attributable to surplus on

sale of two B747-400 freighter aircraft of $46 million and the reduction in statutory tax rate from 20 per cent to 18 per cent,

which resulted in a write-back of $41 million.

As at 31 March 2007, equity holders’ funds of SIA Cargo was $1,905 million (-1.1 per cent), while total assets reached

$3,810 million (+5.4 per cent).

During the year, SIA Cargo leased out two of its B747-400 freighters to Great Wall Airlines and its operating fl eet stood at

14 B747-400 freighters as at 31 March 2007.

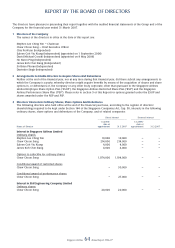

SilkAir

2006-07 2005-06 Change

$ million $ million %

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total revenue 427.8 344.7 + 24.1

Total expenditure 407.8 331.6 + 23.0

Operating profi t 20.0 13.1 + 52.7

Profi t after taxation 19.8 20.6 – 3.9

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

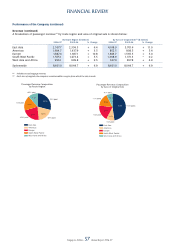

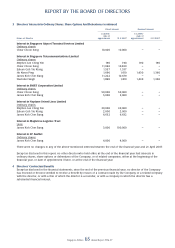

SilkAir’s revenue grew by $83 million (+24.1 per cent) to $428 million from improvements in load (+21.2 per cent) and

overall yield (+1.5 per cent). The increase in expenditure by $76 million (+23.0 per cent) was primarily due to higher fuel cost

(net after fuel hedging), handling and landing charges and aircraft lease rental (an increase of 2 leased aircraft). As a result,

operating profi t improved $7 million (+52.7 per cent).

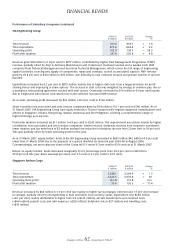

Profi t after taxation declined 3.9 per cent, mainly attributable to lower surplus on disposal of aircraft, spares and spare

engines and higher taxation. This was partially offset by tax write-back of $4 million arising from reduction in statutory tax

rate from 20 per cent to 18 per cent.

Unit cost rose 5.3 per cent to 83.6 cents/ctk while yield improved marginally by 1.5 per cent to 140.8 cents/ltk.

Consequently, breakeven load factor deteriorated by 2.2 percentage points to 59.4 per cent.

Equity holders’ funds of SilkAir was $396 million (+5.0 per cent) as at 31 March 2007.

Capital expenditure for the year was $100 million, mainly for delivery payment for one A320-200 aircraft, pre-delivery

payments for one A319-100 and one A320-200 aircraft scheduled for delivery in 2007 and 2008 respectively, and deposits

and pre-delivery payments for the purchase of 11 aircraft on fi rm order, with another nine on option, under the new aircraft

purchase agreement signed in December 2006.

SilkAir’s route network spanned 26 cities in 10 Asian countries. During the fi nancial year, SilkAir increased frequencies to

selected destination in its existing network to benefi t from the strong economic conditions in Singapore and other key

markets planned.

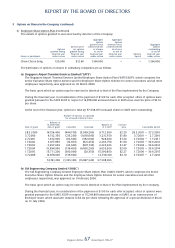

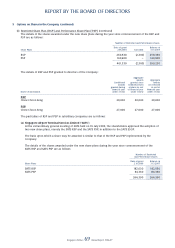

FINANCIAL REVIEW