Singapore Airlines 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 133 Annual Report 2006-07

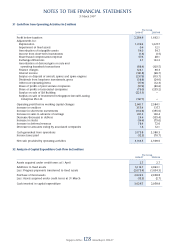

35 Financial Risk Management Objectives and Policies (continued)

(g) Credit risk

There are no signifi cant concentrations of credit risk other than on derivative counterparties where transactions are

limited to fi nancial institutions possessing high credit quality and hence the risk of default is low.

The sale of passenger and cargo transportation is largely achieved through IATA accredited sales agents. The credit

risk of such sales agents is relatively small owing to a broad diversifi cation.

Unless expressly stated otherwise in the contract, receivables and payables among airlines are settled either

bilaterally or via the IATA clearing house. Receivables and payables are generally netted at monthly intervals, which

lead to a clear reduction in the risk of default. In specifi c instances the contract may require special collateral.

For all other service relationships, depending on the nature and scope of the services rendered, collateral is required,

credit reports/references are obtained and use is made of historical data from previous business relations, especially

with regard to payment behaviour, in order to avoid non-performance.

Allowance is made for doubtful accounts whenever risks are identifi ed.

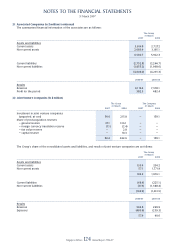

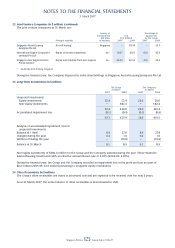

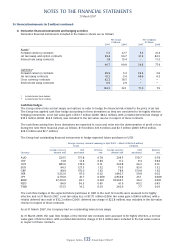

36 Financial Instruments (in $ million)

(a) Fair values

The fair value of a fi nancial instrument is the amount at which the instrument could be exchanged or settled between

knowledgeable and willing parties in an arm’s length transaction, other than in a forced or liquidation sale.

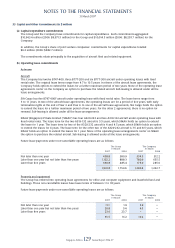

Financial instruments carried at fair value

The Group and Company have carried all investment securities that are classifi ed as available-for-sale fi nancial assets

and all derivative instruments at their fair values.

The fair value of jet fuel swap and jet fuel option contracts are determined by reference to available market

information and the Black-Scholes option valuation model. As the Group hedges its jet fuel requirements in Mean

of Platts Singapore (“MOPS”) and that the majority of the Group’s fuel uplifts are in MOPS, the MOPS price (as at

31 March 2007: USD 80.42/BBL, 2006: USD79.54/BBL) is used as the input for market fuel price to the Black-Scholes

option valuation model. Consequently, the annualised volatility (2006-07: 18.62%, 2005-06: 26.36%) of the jet fuel

swap and jet fuel option contracts is also estimated with daily MOPS price. The continuously compounded risk-free

rate estimated as average of the past 12 months Singapore Government Securities benchmark issues’ one-year yield

(2006-07: 2.97%, 2005-06: 2.40%) was also applied to each individual jet fuel swap and jet fuel option contracts to

derive their estimated fair values as at balance sheet date.

The fair value of forward currency contracts is determined by reference to current forward prices for contracts with

similar maturity profi les.

The fair value of interest rate contracts is calculated using rates assuming these contracts are liquidated at balance

sheet date.

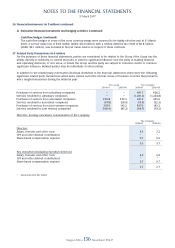

Financial instruments whose carrying amounts approximate fair value

The carrying amounts of the following fi nancial assets and liabilities approximate their fair values due to their

short-term nature: cash and bank balances, bank overdrafts, funds from subsidiary companies, amounts owing

by/to subsidiary, associated and joint venture companies, loans, trade debtors and creditors.