Singapore Airlines 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 136 Annual Report 2006-07

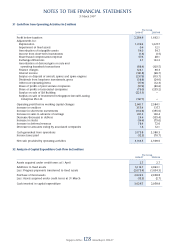

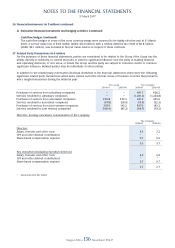

36 Financial Instruments (in $ million) (continued)

(c) Derivative fi nancial instruments and hedging activities (continued)

Cash fl ow hedges (continued)

The cash fl ow hedges of some of the cross currency swaps were assessed to be highly effective and at 31 March

2007, a net fair value loss of $3.8 million (2006: $0.3 million), with a related deferred tax credit of $0.8 million

(2006: $0.1 million), was included in the fair value reserve in respect of these contracts.

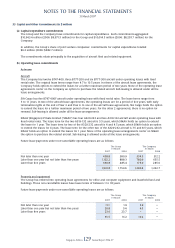

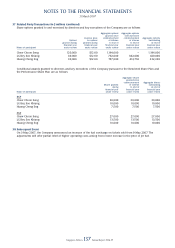

37 Related Party Transactions (in $ million)

For the purposes of these fi nancial statements, parties are considered to be related to the Group if the Group has the

ability, directly or indirectly, to control the party or exercise signifi cant infl uence over the party in making fi nancial

and operating decisions, or vice versa, or where the Group and the party are subject to common control or common

signifi cant infl uence. Related parties may be individuals or other entities.

In addition to the related party information disclosed elsewhere in the fi nancial statements, these were the following

signifi cant related party transactions which were carried out in the normal course of business on terms that prevail in

arm’s length transactions during the fi nancial year:

The Group The Company

2006-07 2005-06 2006-07 2005-06

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Purchases of services from subsidiary companies – – 691.7 609.2

Services rendered to subsidiary companies – – (1,261.2) (1,224.8)

Purchases of services from associated companies 259.8 235.3 241.3 225.0

Services rendered to associated companies (67.8) (28.9) (19.5) (22.3)

Purchases of services from joint venture companies 397.0 143.2 397.0 143.2

Services rendered to joint venture companies (108.9) (85.2) (99.7) (78.2)

Directors’ and key executives’ remuneration of the Company

The Company

2006-07 2005-06

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Directors

Salary, bonuses and other costs 4.3 3.2

CPF and other defi ned contributions * *

Share-based compensation expense 0.7 0.5

––––––––––––––––––––––––––––––––––––

5.0 3.7

––––––––––––––––––––––––––––––––––––

Key executives (excluding executive directors)

Salary, bonuses and other costs 2.0 2.0

CPF and other defi ned contributions * *

Share-based compensation expense 0.7 0.7

––––––––––––––––––––––––––––––––––––

2.7 2.7

––––––––––––––––––––––––––––––––––––

* Amount less than $0.1 million