Singapore Airlines 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 111 Annual Report 2006-07

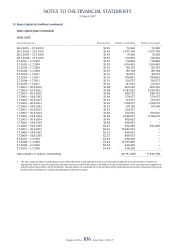

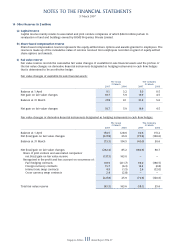

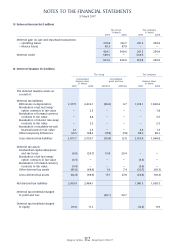

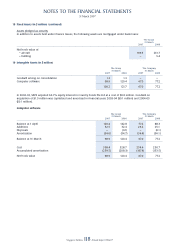

14 Other Reserves (in $ million)

(a) Capital reserve

Capital reserve mainly relates to associated and joint venture companies of which $44.9 million pertain to

revaluation of land and buildings owned by RCMS Properties Private Limited.

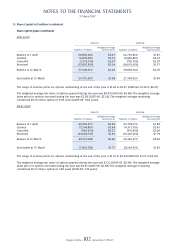

(b) Share-based compensation reserve

Share-based compensation reserve represents the equity-settled share options and awards granted to employees. The

reserve is made up of the cumulative value of services received from employees recorded on grant of equity-settled

share options and awards.

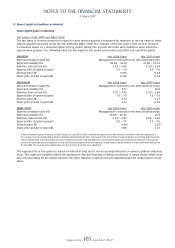

(c) Fair value reserve

Fair value reserve records the cumulative fair value changes of available-for-sale fi nancial assets and the portion of

the fair value changes on derivative fi nancial instruments designated as hedging instruments in cash fl ow hedges

that is determined to be an effective hedge.

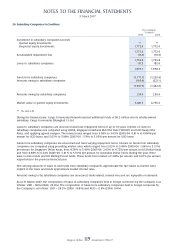

Fair value changes of available-for-sale fi nancial assets:

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 9.1 3.2 5.0 0.5

Net gain on fair value changes 18.7 5.9 16.9 4.5

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 27.8 9.1 21.9 5.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net gain on fair value changes 18.7 5.9 16.9 4.5

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

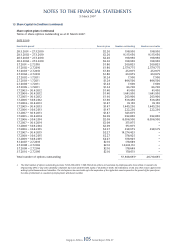

Fair value changes of derivative fi nancial instruments designated as hedging instruments in cash fl ow hedges:

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 154.5 128.6 30.6 151.2

Net (loss)/gain on fair value changes (227.8) 25.9 (70.6) (120.6)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March (73.3) 154.5 (40.0) 30.6

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net (loss)/gain on fair value changes (232.4) 85.2 (180.6) 60.7

Share of joint venture and associated companies’

net (loss)/gain on fair value reserve (137.3) 163.0 – –

Recognised in the profi t and loss account on occurrence of:

Fuel hedging contracts 118.9 (211.7) 94.0 (166.5)

Foreign currency contracts 15.7 (6.3) 13.4 (2.8)

Interest rate swap contracts 4.9 (1.5) 2.6 (12.0)

Cross currency swap contracts 2.4 (2.8) – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

(227.8) 25.9 (70.6) (120.6)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total fair value reserve (45.5) 163.6 (18.1) 35.6

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––