Singapore Airlines 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 99 Annual Report 2006-07

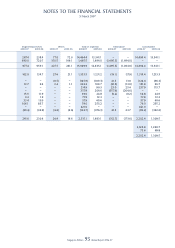

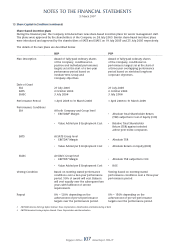

11 Earnings Per Share

The Group

2006-07 2005-06

Basic Diluted Basic Diluted

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Profi t attributable to

equity holders of the Company (in $ million) 2,128.8 2,128.8 1,240.7 1,240.7

Adjustment for dilutive potential ordinary shares

of subsidiaries (in $ million) – (4.8) – (3.6)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Adjusted net profi t attributable to

equity holders of the Company (in $ million) 2,128.8 2,124.0 1,240.7 1,237.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Weighted average number of ordinary shares

in issue (in million) 1,233.6 1,233.6 1,219.5 1,219.5

Adjustment for dilutive potential

ordinary shares (in million) – 10.0 – 2.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Weighted average number of ordinary shares

in issue used for computing

earnings per share (in million) 1,233.6 1,243.6 1,219.5 1,221.6

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Earnings per share (cents) 172.6 170.8 101.7 101.3

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Basic earnings per share is calculated by dividing the profi t attributable to equity holders by the weighted average

number of ordinary shares in issue during the fi nancial year.

For purposes of calculating diluted earnings per share, the profi t attributable to equity holders of the Company is

adjusted to take into account effects of dilutive potential ordinary shares of subsidiaries and the weighted average

number of ordinary shares of the Company in issue is adjusted to take into account effects of dilutive options of the

Company.

21.8 million (2005-06: 47.9 million) of the share options granted to employees under the existing employee share option

plans have not been included in the calculation of diluted earnings per share because they are anti-dilutive for the

current and previous years presented.

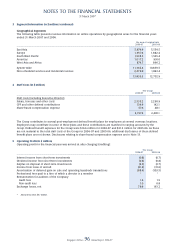

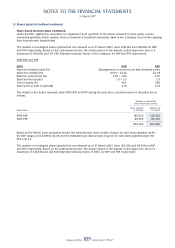

12 Dividends Paid and Proposed (in $ million)

The Group and the Company

2006-07 2005-06

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Dividends paid:

Final dividend of 35.0 cents per share tax exempt (one-tier) in respect of 2005-06

(2005-06: 30.0 cents per share tax exempt [one-tier] in respect of 2004-05) 429.4 365.7

Interim dividend of 15.0 cents per share tax exempt (one-tier) in respect of

current fi nancial year (2005-06: 10.0 cents per share tax exempt [one-tier] in

respect of 2005-06) 185.4 121.9

––––––––––––––––––––––––––––––––––––

614.8 487.6

––––––––––––––––––––––––––––––––––––

The directors propose that a fi nal tax exempt (one-tier) dividend of 35.0 cents per share (2005-06: 35.0 cents per share)

and a special tax exempt (one-tier) dividend of 50.0 cents per share (2005-06: Nil) amounting to $436.4 million

(2005-06: $429.4 million) and $623.4 million (2005-06: Nil) respectively be paid for the fi nancial year ended

31 March 2007.