Singapore Airlines 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 110 Annual Report 2006-07

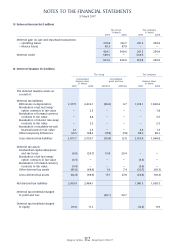

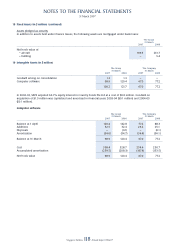

13 Share Capital (in $ million) (continued)

Share-based incentive plans (continued)

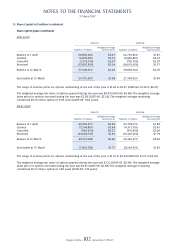

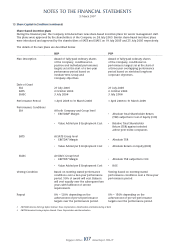

SIAEC RSP and PSP

SIAEC RSP PSP

Expected dividend yield (%) Management’s forecast in line with dividend policy

Expected volatility (%) 16.82 – 22.31 17.49

Risk-free interest rate (%) 2.99 – 3.25 3.16

Expected term (years) 1.75 – 3.75 2.75

Cost of equity (%) N.A. 8.50

Share price at date of grant ($) 3.96 3.96

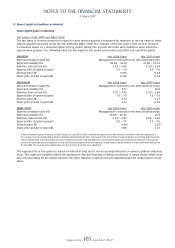

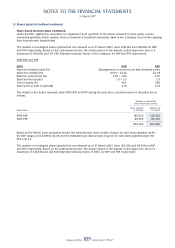

The details of the shares awarded under SIAEC RSP and PSP during the year since commencement of the plans are as

follows:

Number of Restricted and Performance shares

––––––––––––––––––––––––––––––––––––––––––––––––––––––

Date of grant Balance at

Share Plans 3.7.2006 Cancelled 31.3.2007

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

SIAEC RSP 205,200 (2,000) 203,200

SIAEC PSP 36,900 – 36,900

––––––––––––––––––––––––––––––––––––––––––––––––––––––

242,100 (2,000) 240,100

––––––––––––––––––––––––––––––––––––––––––––––––––––––

Based on the Monte Carlo simulation model, the estimated fair value at date of grant for each share granted under

the RSP ranges from $3.71 to $3.84 and the estimated fair value at date of grant for each share granted under the

PSP is $4.04.

The number of contingent shares granted but not released as at 31 March 2007, were 203,200 and 36,900 for RSP

and PSP respectively. Based on the achievement factor, the actual release of the awards could range from zero to a

maximum of 243,840 and 55,350 fully-paid ordinary shares of SIAEC, for RSP and PSP respectively.

For the current fi nancial year, the Group has recorded $1.8 million (2006: Nil) in respect of the RSP and PSP based on the

fair values determined on grant date and estimation of share grants that will ultimately vest.

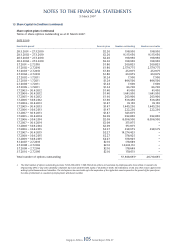

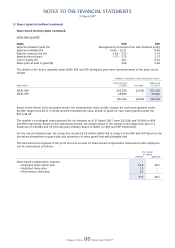

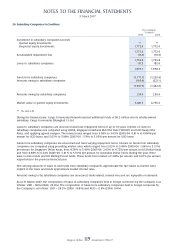

The total amount recognised in the profi t and loss account for share-based compensation transactions with employees

can be summarised as follows:

The Group

31 March

2006-07 2005-06

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Share-based compensation expense

– Employee share option plan 55.8 48.1

– Restricted share plan 1.5 –

– Performance share plan 0.3 –

––––––––––––––––––––––––––––––––––––

57.6 48.1

––––––––––––––––––––––––––––––––––––