Singapore Airlines 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 108 Annual Report 2006-07

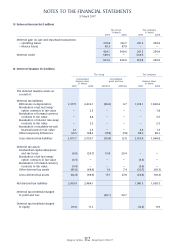

13 Share Capital (in $ million) (continued)

Share-based incentive plans (continued)

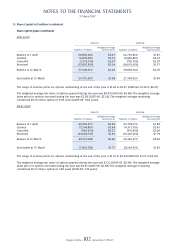

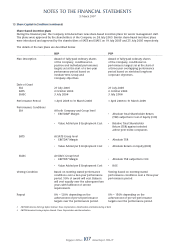

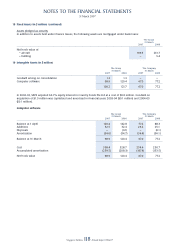

Fair values of RSP and PSP

SIA RSP and PSP

The fair value of services received in return for shares awarded is measured by reference to the fair value of shares

granted each year under the SIA RSP and PSP. The estimate of the fair value of the services received is measured based

on a Monte Carlo simulation model, which involves projection of future outcomes using statistical distributions of key

random variables including share price and volatility of returns.

The following table lists the inputs to the model used for the July 2006 award:

SIA RSP PSP

Expected dividend yield (%) Management’s forecast in line with dividend policy

Expected volatility (%) 18.28 – 22.66 19.31

Risk-free interest rate (%) 3.06 – 3.29 3.21

Expected term (years) 1.7 – 3.7 2.7

Cost of equity (%) N.A. 8.44

Share price at date of grant ($) 13.20 13.20

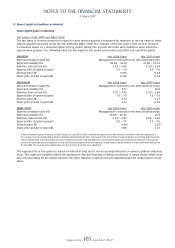

For non-market conditions, achievement factors are determined based on inputs from the Board Compensation and

Industrial Relations Committee for the purpose of accrual for the RSP until the achievement of the targets can be

accurately ascertained.

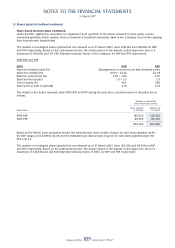

The details of the shares awarded under the new share plans during the year since commencement of the RSP and PSP

are as follows:

Number of Restricted and Performance shares

––––––––––––––––––––––––––––––––––––––––––––––––––––––

Date of grant Balance at

Share Plans 27.7.2006 Cancelled 31.3.2007

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

RSP 260,630 (2,300) 258,330

PSP 140,900 – 140,900

––––––––––––––––––––––––––––––––––––––––––––––––––––––

401,530 (2,300) 399,230

––––––––––––––––––––––––––––––––––––––––––––––––––––––

Based on the Monte Carlo simulation model, the estimated fair value at date of grant for each share granted under the

RSP ranges from $11.55 to $12.45 and the estimated fair value at date of grant for each share granted under the PSP is

$7.02.

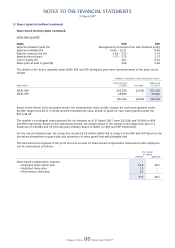

When estimating the fair value of the compensation cost, market-based performance conditions shall be taken into

account. Therefore, for performance share grants with market-based performance conditions, the compensation cost

shall be charged to the profi t and loss account on a basis that fairly refl ects the manner in which the benefi ts will accrue

to the employee under the plan over the remaining service period from date of grant to which the performance period

relates, irrespective of whether this performance condition is satisfi ed.

For performance share grants with non-market conditions, the Group revises its estimates of the number of share grants

expected to vest and corresponding adjustments are made to the profi t and loss account and share-based compensation

reserve.