Singapore Airlines 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 102 Annual Report 2006-07

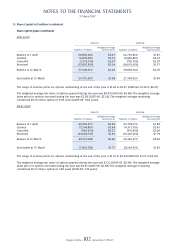

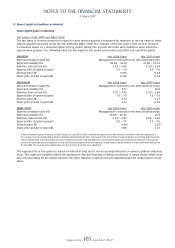

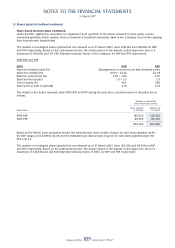

13 Share Capital (in $ million) (continued)

Share option plans (continued)

SATS ESOP

2006-07 2005-06

–––––––––––––––––––––––––––––––––––––––––––– ––––––––––––––––––––––––––––––––––––––––––––

Weighted average Weighted average

Number of options exercise price Number of options exercise price

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 59,863,300 $2.07 62,756,850 $1.87

Granted 14,878,000 $2.10 15,865,800 $2.27

Cancelled (1,335,100) $2.07 (705,700) $2.07

Exercised (15,897,545) $2.04 (18,053,650) $1.57

–––––––––––––––––––––––––– –––––––––––––––––––––––––

Balance at 31 March 57,508,655 $2.09 59,863,300 $2.07

–––––––––––––––––––––––––– –––––––––––––––––––––––––

Exercisable at 31 March 26,710,655 $1.98 27,346,625 $1.96

–––––––––––––––––––––––––– –––––––––––––––––––––––––

The range of exercise prices for options outstanding at the end of the year is $1.24 to $2.27 (2005-06: $1.24 to $2.27).

The weighted average fair value of options granted during the year was $0.45 (2005-06: $0.48). The weighted average

share price for options exercised during the year was $2.38 (2005-06: $2.30). The weighted average remaining

contractual life for these options is 6.93 years (2005-06: 6.84 years).

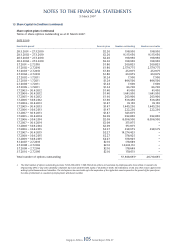

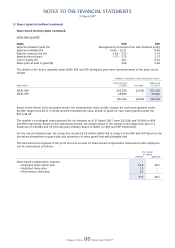

SIAEC ESOP

2006-07 2005-06

–––––––––––––––––––––––––––––––––––––––––––– ––––––––––––––––––––––––––––––––––––––––––––

Weighted average Weighted average

Number of options exercise price Number of options exercise price

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 60,225,575 $2.02 63,709,775 $1.84

Granted 15,244,800 $3.44 16,313,700 $2.45

Cancelled (648,350) $2.27 (416,850) $2.06

Exercised (25,090,737) $1.65 (19,381,050) $1.79

–––––––––––––––––––––––––– –––––––––––––––––––––––––

Balance at 31 March 49,731,288 $2.40 60,225,575 $2.02

–––––––––––––––––––––––––– –––––––––––––––––––––––––

Exercisable at 31 March 17,836,788 $1.71 28,144,350 $1.85

–––––––––––––––––––––––––– –––––––––––––––––––––––––

The range of exercise prices for options outstanding at the end of the year is $1.01 to $3.44 (2005-06: $1.21 to $2.45).

The weighted average fair value of options granted during the year was $1.22 (2006-05: $0.49). The weighted average

share price for options exercised during the year was $3.91 (2005-06: $2.58). The weighted average remaining

contractual life for these options is 7.49 years (2005-06: 7.18 years).