Singapore Airlines 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines 2 Annual Report 2006-07

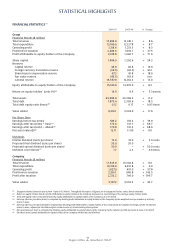

STATISTICAL HIGHLIGHTS

FINANCIAL STATISTICS R1

2006-07 2005-06 % Change

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Group

Financial Results ($ million)

Total revenue 14,494.4 13,341.1 + 8.6

Total expenditure 13,180.0 12,127.8 + 8.7

Operating profi t 1,314.4 1,213.3 + 8.3

Profi t before taxation 2,284.6 1,662.1 + 37.5

Profi t attributable to equity holders of the Company 2,128.8 1,240.7 + 71.6

Share capital 1,494.9 1,202.6 + 24.3

Reserves

Capital reserve 44.9 40.8 + 10.0

Foreign currency translation reserve (59.5) (30.5) + 95.1

Share-based compensation reserve 97.3 81.8 + 18.9

Fair value reserve (45.5) 163.6 n.m.

General reserve 13,567.9 12,012.3 + 13.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Equity attributable to equity holders of the Company 15,100.0 13,470.6 + 12.1

Return on equity holders’ funds (%) R2 14.9 9.6 + 5.3 points

Total assets 25,992.0 23,369.5 + 11.2

Total debt 1,879.4 2,305.6 – 18.5

Total debt equity ratio (times) R3 0.12 0.17 – 0.05 times

Value added 6,510.1 5,534.0 + 17.6

Per Share Data

Earnings before tax (cents) 185.2 136.3 + 35.9

Earnings after tax (cents) – basic R4 172.6 101.7 + 69.7

Earnings after tax (cents) – diluted R5 170.8 101.3 + 68.6

Net asset value ($) R6 12.11 11.00 + 10.1

Dividends

Interim dividend (cents per share) 15.0 10.0 + 5.0 cents

Proposed fi nal dividend (cents per share) 35.0 35.0 –

Proposed special dividend (cents per share) 50.0 – + 50.0 cents

Dividend cover (times) R7 1.7 2.3 – 0.6 times

Company

Financial Results ($ million)

Total revenue 11,343.9 10,302.8 + 10.1

Total expenditure 10,316.9 9,651.8 + 6.9

Operating profi t 1,027.0 651.0 + 57.8

Profi t before taxation 2,291.1 940.8 + 143.5

Profi t after taxation 2,213.2 746.0 + 196.7

Value added 5,107.2 3,553.2 + 43.7

R1 Singapore Airlines’ fi nancial year is from 1 April to 31 March. Throughout this report, all fi gures are in Singapore Dollars, unless stated otherwise.

R2 Return on equity holders’ funds is profi t attributable to equity holders of the Company expressed as a percentage of the average equity holders’ funds.

R3 Total debt equity ratio is total debt divided by equity attributable to equity holders of the Company as at 31 March.

R4 Earnings after tax per share (basic) is computed by dividing profi t attributable to equity holders of the Company by the weighted average number of ordinary

shares in issue.

R5 Earnings after tax per share (diluted) is computed by dividing profi t attributable to equity holders of the Company by the weighted average number of ordinary

shares in issue, adjusted for the dilutive effect on the exercise of all outstanding share options.

R6 Net asset value per share is computed by dividing equity attributable to equity holders of the Company by the number of ordinary shares in issue at 31 March.

R7 Dividend cover is profi t attributable to equity holders of the Company divided by total dividend.