Singapore Airlines 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 125 Annual Report 2006-07

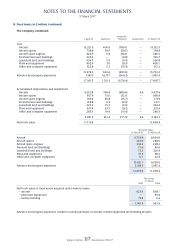

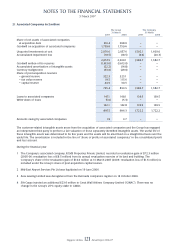

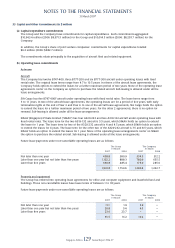

22 Joint Venture Companies (in $ million) (continued)

The joint venture companies at 31 March are:

Country of Percentage of

incorporation Cost equity held

and place (in $ million) by the Group

Principal activities

of business

2007 2006 2007 2006

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Singapore Aircraft Leasing Aircraft leasing Singapore – 159.14 – 35.5

Enterprise Pte Ltd

International Engine Component Repair of aircraft components - do - 10.07 10.07 41.0 42.0

Overhaul Pte Ltd*

Singapore Aero Engine Services Repair and maintain Trent aero engines - do - 46.53 46.53 41.0 42.0

Private Limited*

* Audited by Ernst & Young, Singapore.

During the fi nancial year, the Company disposed its entire shareholdings in Singapore Aircraft Leasing Enterprise Pte Ltd.

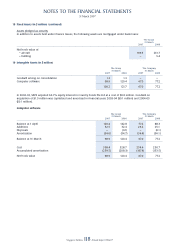

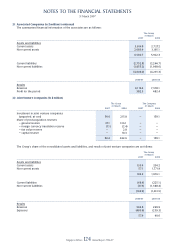

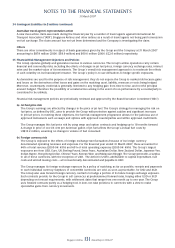

23 Long-Term Investments (in $ million)

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Unquoted investments

Equity investments 52.4 52.4 28.0 28.0

Non-equity investments – 382.4 – 382.4

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

52.4 434.8 28.0 410.4

Accumulated impairment loss (9.1) (8.9) (9.1) (8.9)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

43.3 425.9 18.9 401.5

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Analysis of accumulated impairment loss for

unquoted investments

Balance at 1 April 8.9 27.8 8.9 27.8

Charged during the year 0.2 1.0 0.2 1.0

Written-off during the year – (19.9) – (19.9)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 9.1 8.9 9.1 8.9

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Non-equity investments of $382.4 million for the Group and the Company matured during the year. These related to

interest-bearing investments with an effective annual interest rate of 3.97% (2005-06: 3.97%).

During the fi nancial year, the Group and the Company recorded an impairment loss in the profi t and loss account of

$0.2 million (2005-06: $1.0 million) pertaining to unquoted equity investments.

24 Other Receivables (in $ million)

The Group’s other receivables are stated at amortised cost and are expected to be received over the next 3 years.

As at 31 March 2007, the entire balance of other receivables is denominated in USD.