Singapore Airlines 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 127 Annual Report 2006-07

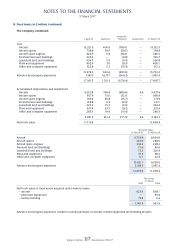

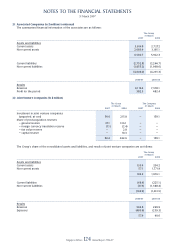

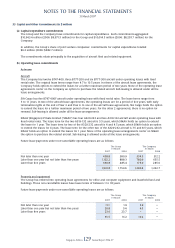

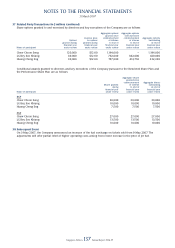

28 Cash and Bank Balances (in $ million)

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fixed deposits 4,385.5 2,451.9 4,084.6 2,256.0

Cash and bank 732.1 699.7 542.9 509.1

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

5,117.6 3,151.6 4,627.5 2,765.1

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

As at 31 March 2007, the composition of cash and bank balances held in foreign currencies by the Group is as follows:

USD – 27.3% (2006: 21.8%), EUR – 9.1% (2006: 13.6%) and JPY – 5.6% (2006: 13.2%).

Cash at bank earns interest at fl oating rates based on daily bank deposit rates ranging from 2.17% to 6.27%

(2005-06: 1.38% to 4.71%) per annum. Short-term deposits are made for varying periods of between one day and three

months depending on the immediate cash requirements of the Group, and earn interests at the respective short-term

deposit rates. The weighted average effective interest rate of short-term deposits is 4.3% (2005-06: 3.6%) per annum.

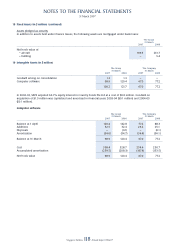

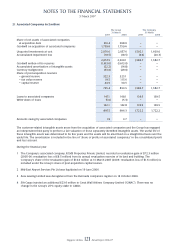

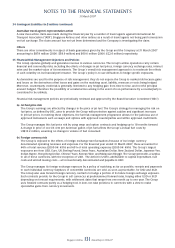

29 Trade Creditors (in $ million)

Included in trade creditors are provision for warranty claims of $1.6 million (2006: $3.0 million) for the Group and

provision for return costs for aircrafts under sales and leaseback arrangement of $101.0 million (2006: $83.8 million) and

$90.5 million (2006: $79.8 million) for the Group and the Company respectively.

An analysis of provision for warranty claims is as follows:

The Group

31 March

2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 3.0 2.8

(Writeback)/Provision during the year (1.0) 0.5

Provision utilised during the year (0.4) (0.3)

––––––––––––––––––––––––––––––––––––

Balance at 31 March 1.6 3.0

––––––––––––––––––––––––––––––––––––

An analysis of provision for return costs for aircrafts under sales and leaseback arrangement is as follows:

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 83.8 75.1 79.8 73.8

Provision during the year 17.6 10.3 11.1 7.6

Provision utilised during the year (0.4) (1.6) (0.4) (1.6)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 101.0 83.8 90.5 79.8

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

As at 31 March 2007, 19.0% of trade creditors (2006: 18.9%) were held in USD by the Group.

30 Bank Overdrafts (in $ million)

The bank overdraft as at 31 March 2007 is unsecured. As at 31 March 2006, $0.4 million of the Group’s bank overdrafts

was secured by a fi rst legal mortgage over a building at 22 Senoko Way, Singapore 758044. Interest is charged at a rate

of 3.95% (2005-06: 3.95%) per annum in the current fi nancial year.

As at 31 March 2007, the composition of bank overdraft held in foreign currencies by the Group is as follows:

USD – 13.8% (2006: 22.3%), AUD – 73.8% (2006: Nil) and EUR – 0.6% (2006: 20.5%).