Singapore Airlines 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 112 Annual Report 2006-07

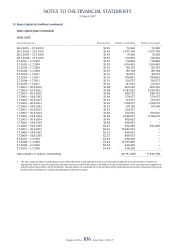

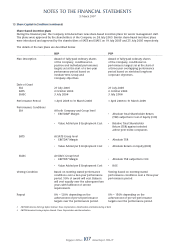

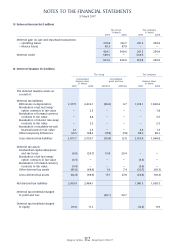

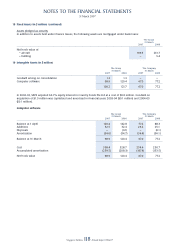

15 Deferred Account (in $ million)

The Group The Company

31 March 31 March

2007 2006 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Deferred gain on sale and leaseback transactions

– operating leases 374.8 301.7 261.3 254.9

– fi nance leases 49.3 47.9 – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

424.1 349.6 261.3 254.9

Deferred credit 549.5 – 549.5 –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

973.6 349.6 810.8 254.9

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

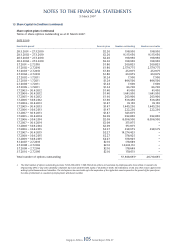

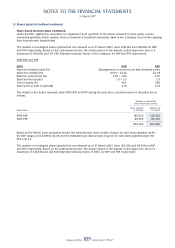

16 Deferred Taxation (in $ million)

The Group The Company

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– ––––––––––––––––––––––––––––

Consolidated Consolidated

balance sheet profit and loss Balance sheet

31 March 31 March

2007 2006 2006-07 2005-06 2007 2006

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The deferred taxation arises as

a result of:

Deferred tax liabilities

Differences in depreciation 2,377.1 2,436.1 (59.0) 4.7 1,918.1 1,860.6

Revaluation of jet fuel swap/

option contracts to fair value – 2.3 – – – 1.8

Revaluation of forward currency

contracts to fair value – 4.4 – – – 3.5

Revaluation of interest rate swap

contracts to fair value – 2.3 – – – 2.3

Revaluation of available-for-sale

fi nancial assets to fair value 6.1 2.3 – – 4.8 1.3

Other temporary differences 90.5 108.3 (17.8) (7.8) 88.0 99.3

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gross deferred tax liabilities 2,473.7 2,555.7 (76.8) (3.1) 2,010.9 1,968.8

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

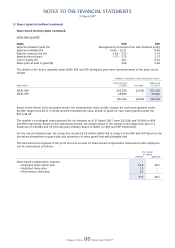

Deferred tax assets

Unabsorbed capital allowances

and tax losses (8.9) (24.7) 15.8 20.4 – –

Revaluation of jet fuel swap/

option contracts to fair value (6.5) – – – (5.3) –

Revaluation of forward currency

contracts to fair value (4.4) – – – (3.4) –

Other deferred tax assets (43.0) (44.9) 1.9 7.4 (20.7) (18.3)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gross deferred tax assets (62.8) (69.6) 17.7 27.8 (29.4) (18.3)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net deferred tax liabilities 2,410.9 2,486.1 1,981.5 1,950.5

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Deferred tax (credited)/charged

to profi t and loss (59.1) 24.7

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Deferred tax (credited)/charged

to equity (16.1) 11.3 (12.8) 8.9

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––