Western Union 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Notes to Consolidated Financial Statements 95

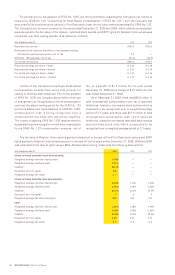

For periods presented prior to the spin-off date of

September 29, 2006, all stock-based compensation awards

were made by First Data, and used First Data assumptions

for volatility, dividend yield and term. Western Union

assumptions, which are described in the paragraphs below,

were utilized for grants made by Western Union on

September 29, 2006 and subsequent thereto.

EXPEC TED VOLATILI T Y

—

Western Union’s expected

weighted-average volatility of 26.4% was determined

based on the calculated historical peer group volatility for

companies in similar industries, stage of life cycle, and

market capitalization since there is not sufficient historical

volatility data for Western Union common stock. Expected

volatility for the Company’s 2006 grants, which varies by

group based on the expected option term, was 28.4% for

the Board of Directors and executives and 24.7% for non-

executive employees. Beginning in 2006, First Data used

the implied volatility method for estimating expected

volatility for all stock options granted and ESPP rights. First

Data calculated its implied volatility on a daily basis using

a Black-Scholes option pricing model, incorporating the

market prices of a variety of traded options, the market

price of First Data stock, the exercise price and remaining

term of the traded options, the expected dividends and

the risk-free rate.

EXPECTED DIVIDEND YIELD

—

The Company’s expected

annual dividend yield is calculated based on Western Union’s

average stock price on each respective grant date. The

assumed annual dividend is four cents per common share.

First Data’s dividend yield is the calculation of the annualized

First Data dividend amount of $0.24 divided by a rolling

12 month average First Data stock price as of the most

recent grant date for which First Data granted options to

Western Union employees.

EXPECTED TERM

—

Western Union’s expected term is

5.8 years for non-executive employees, and 7.5 years for

the Board of Directors and executives. The Company’s

expected term of options was based upon, among other

things, historical exercises (including the exercise history

of First Data’s awards), the vesting term of the Company’s

options, the cancellation history of the Company’s employees

options in First Data stock and the options’ contractual

term of ten years. First Data has also aggregated stock

option awards into classes. For each class, the expected

term is primarily based on the results of a study performed

on the historical exercise and post-vesting employment

termination behavior for similar grants. First Data’s

expected terms were as follows: 4.5 years for non-executive

employees, 7 years for the Board of Directors and 7.5 years

for its executives. The expected term of ESPP rights were

determined to be 0.25 years as purchase rights are achieved

over the course of the quarter in which the employee

participated in the ESPP. Once the shares have been

purchased, the employee can sell their respective shares.

RISK-FREE INTEREST RATE

—

The risk-free rate for stock

options granted during the period is determined by using

a U.S. Treasury rate for the period that coincided with the

expected terms listed above. The risk-free rate for ESPP

rights was determined using a 3-month maturity U.S.

Treasury bond rate for the 90-day period that coincided

with the expected terms listed above.

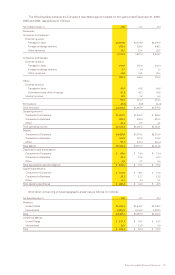

The assumptions used to calculate the fair value of

options granted will be evaluated and revised, as necessary,

to reflect market conditions and the Company’s historical

experience and future expectations. The calculated fair

value is recognized as compensation cost in the Company’s

financial statements over the requisite service period

of the entire award. Compensation cost is recognized

only for those options expected to vest, with forfeitures

estimated at the date of grant and evaluated and adjusted

periodically to reflect the Company’s historical experience

and future expectations. Any change in the forfeiture

assumption will be accounted for as a change in estimate,

with the cumulative effect of the change on periods

previously reported being reflected in the financial

statements of the period in which the change is made.

In the future, as more historical data is available to calculate

the volatility of Western Union stock and the actual terms

Western Union employees hold options, expected

volatility and expected term may change which could

substantially change the grant-date fair value of future

stock option awards and, ultimately, the recorded

compensation expense.