Western Union 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 56

Proceeds from Net Borrowings Under Credit Facilities

During September 2006, we made an initial borrowing

under our Revolving Credit Facility in an aggregate principal

amount equal to $100.0 million in connection with the

spin-off which was fully repaid prior to December 31, 2006.

We also incurred net borrowings of $3.0 million, due

January 2, 2007, through a fixed rate promissory note as

of December 31, 2006.

Proceeds from Exercise of Options

We received $80.8 million in cash proceeds related to

the exercise of 5.4 million stock options subsequent

to the spin-off date of September 29, 2006 through

December 31, 2006. More than 80% of the 5.4 million

shares exercised related to stock options held by First Data

employees.

Cash Dividends to Public Stockholders

During the fourth quarter of 2006, our Board of Directors

declared a quarterly cash dividend of $0.01 per common

share representing $7.7 million which was paid in

December 2006.

Purchase of treasury shares

In September 2006, our Board of Directors authorized

the purchase of up to $1.0 billion of our common stock on

the open market through December 31, 2008. As

of December 31, 2006, 0.9 million shares have been

repurchased for $19.9 million at an average cost of $22.79

per share.

|| Significant Non-Cash

Transactions

On September 29, 2006, we issued to First Data $1.0 billion

aggregate principal amount of the 2016 Notes in partial

consideration for the contribution by First Data to us of its

money transfer and consumer payments businesses in

connection with the spin-off. Immediately after the

Distribution, First Data exchanged the 2016 Notes with

two financial institutions for indebtedness of First Data

that the financial institutions held at that time. The financial

institutions received the proceeds from the subsequent

sale of the 2016 Notes in a private offering.

On September 29, 2006, we also issued 765.3 million

shares of our common stock to First Data in partial

consideration for the contribution by First Data to us of its

money transfer and consumer payments businesses in

connection with the spin-off. First Data then distributed

the 765.3 million shares of our common stock to First

Data’s shareholders.

First Data transferred to us our headquarters in

Englewood, Colorado and certain other fixed assets with

a net book value of $66.5 million, and we transferred to

First Data certain investments with a net book value

of $20.9 million. We also reclassified liabilities totaling

$193.8 million relating to certain tax and employee-related

obligations from “Receivables from First Data, net.”

|| Off-Balance Sheet Arrangements

Other than facility and equipment leasing arrangements,

we have no material off-balance sheet arrangements that

have or are reasonably likely to have a material current

or future effect on our financial condition, revenues

or expenses, results of operations, liquidity, capital

expenditures or capital resources.

|| Pension Plans

We have two frozen defined benefit plans that

together were underfunded by $52.9 million as of

December 31, 2006. In 2006, we did not make a

contribution to these plans, and currently do not anticipate

contributing to these plans in 2007 since, based on

current asset return calculations and minimum funding

requirements, no such contribution is required. We do not

believe that legislation enacted during 2006 relating

to pension plans will have an impact on our funding

requirement until at least 2008. During 2008, in connection

with the adoption of SFAS No. 158, “Employers Accounting

for Defined Benefit Pension and Other Postretirement

Plans, An Amendment of SFAS No. 87, 88, 106 and 132(R)”

(“SFAS No. 158”), the measurement dates for our pension

plans will be changed to December 31 from a present

measurement date of September 30.

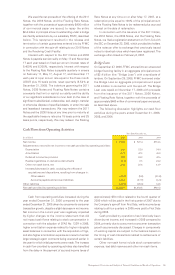

|| Contractual Obligations

The following table summarizes our contractual obligations to third parties as of December 31, 2006 and the effect such

obligations are expected to have on our liquidity and cash flows in future periods (in millions).

Payments Due by Period

Total Less than 1 Year 1-3 Years 4-5 Years After 5 Years

Borrowings, including interest

(a) $5,155.3 $508.2 $812.2 $1,282.0 $2,552.9

Operating leases 79.3 20.5 26.0 13.1 19.7

Purchase obligations

(b) 158.1 42.8 59.8 33.0 22.5

$5,392.7 $571.5 $898.0 $1,328.1 $2,595.1

(a) We have estimated our interest payments based on i) projected LIBOR rates in calculating interest on commercial paper borrowings and Floating Rate Notes, ii) projected com-

mercial paper borrowings outstanding throughout 2007, and the assumption that no such amounts will be outstanding on or after December 31, 2007, and iii) the assumption that

no debt issuances or renewals will occur upon the maturity dates of our fixed and floating rate notes.

(b) Many of our contracts contain clauses that allow us to terminate the contract with notice, and with or without a termination penalty. Termination penalties are generally an amount

less than the original obligation. Certain contracts also have an automatic renewal clause if we do not provide written notification of our intent to terminate the contract. Obligations

under certain contracts are usage-based and are, therefore, estimated in the above amounts. Historically, we have not had any significant defaults of our contractual obligations or

incurred significant penalties for termination of our contractual obligations.