Western Union 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

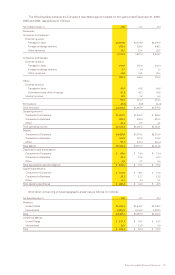

Notes to Consolidated Financial Statements 93

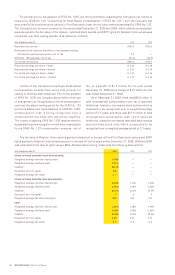

Stock-Based Compensation

In December 2005, First Data accelerated vesting of all

outstanding unvested stock options granted by First Data

to its officers and employees under First Data’s 2002

Long-Term Incentive Plan. The decision to accelerate the

vesting of these stock options was made primarily to reduce

stock-based compensation expense that otherwise likely

would be recorded in future periods following the adoption

of SFAS No. 123R. The Company recognized compensation

expense of $1.8 million during the fourth quarter of 2005

resulting from accelerated vesting. The Company must

recognize compensation expense related to any awards

outside of the First Data 2002 Long-Term Incentive Plan

that were not fully vested as of January 1, 2006, as well

as options granted after that date under either the First

Data plan or the Western Union plans.

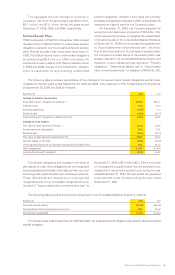

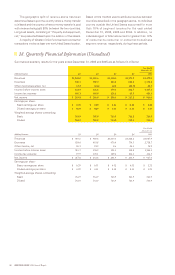

As discussed in Note 1, effective January 1, 2006, the

Company adopted SFAS No. 123R following the modified

prospective method. The following table sets forth the

total impact on earnings for stock-based compensation

expense recognized in the Consolidated Statements of

Income resulting from stock options, restricted stock

awards, restricted stock units, and ESPP rights for Western

Union employees for the year ended December 31, 2006

(in millions). A benefit to earnings is reflected as a positive

and a reduction to earnings is reflected as a negative.

Year Ended

December 31, 2006

Income before income taxes $(23.3)

Income tax benefit from stock-based

compensation expense 8.8

Net income $(14.5)

Earnings per share:

Basic $(0.02)

Diluted $(0.02)

There was no stock-based compensation capitalized

during the year ended December 31, 2006. In addition, the

Company was allocated stock-based compensation expense

of $6.8 million during the year ended December 31, 2006

related to employees of First Data providing administrative

services to the Company prior to the spin-off. Including

allocations from First Data, total stock compensation

expense was $30.1 million in 2006 and $7.2 million in 2005.

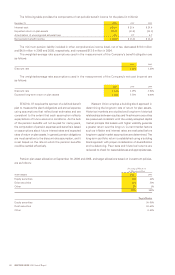

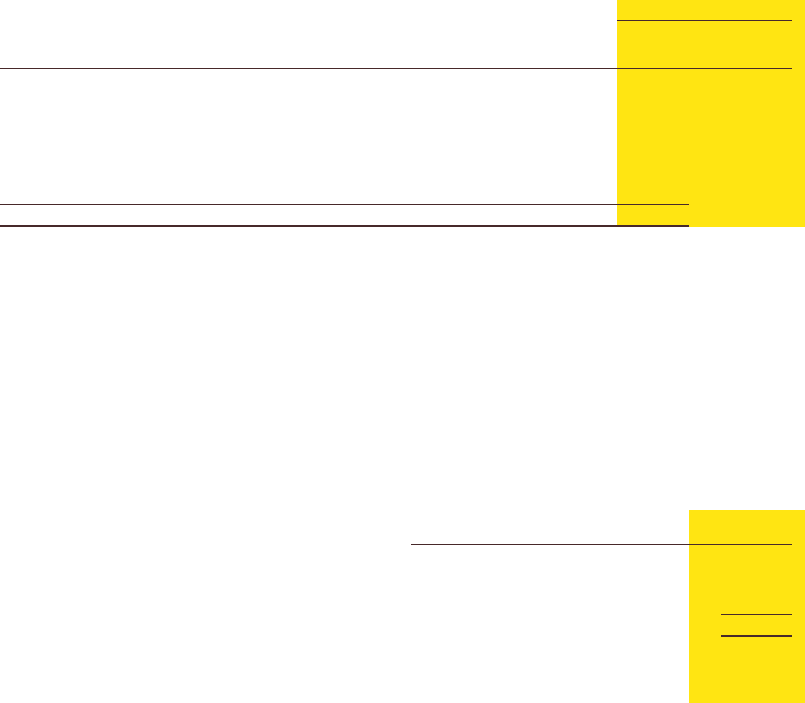

A summary of Western Union activity for restricted stock awards and units relating to Western Union and First Data

employees for the year ended December 31, 2006 is listed below (awards/units in millions). All restricted stock awards

and units have been adjusted to reflect the conversion ratio as of the date of the spin-off, as all restricted stock

awards and units prior to the spin-off were in First Data stock:

Year Ended December 31, 2006

Weighted-Average

Number Grant-Date

Outstanding Fair Value

Non-vested at January 1, 0.2 $18.42

Granted 1.9 19.51

Western Union unvested restricted stock awards and units

issued to First Data employees on spin-off date 1.1 20.49

Vested (0.1) 18.76

Forfeited (0.1) 20.48

Non-vested at December 31, 3.0 $19.80