Western Union 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION 2006 Annual Report 82

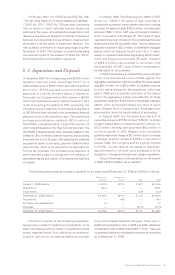

The Company’s effective tax rates on pretax

income were 32%, 31%, and 32% for the years ended

December 31, 2006, 2005, and 2004, respectively. The

effective tax rate over the three periods remained

relatively constant, with 2005 benefiting slightly from

certain state tax adjustments.

The Company has established contingency reserves

for material, known tax exposures, including potential

tax audit adjustments with respect to our international

operations, which were restructured in 2003. The Company’s

tax reserves reflect what it believes to be reasonable

assumptions as to the likely resolution of the issues involved

if subject to judicial review. While the Company believes

that its reserves are adequate to cover reasonably expected

tax risks, there can be no assurance that, in all instances,

an issue raised by a tax authority will be resolved at

a financial cost that does not exceed its related reserve.

Any difference from the Company’s position as recorded

in its financial statements and the final resolution of a tax

issue will be reflected in the Company’s income tax expense

in the period during which the issue is resolved. Such

resolution could also affect the Company’s effective tax

rate in future periods.

To address certain tax aspects of the 2003 restructuring

of the Company’s international operations, discussions

were initiated with the Internal Revenue Service (“IRS”)

pursuant to its Advance Pricing Agreement, or “APA,”

Program. The Company, however, was notified by the

IRS in October 2006 that it will not be able to conclude

an arrangement acceptable to the Company through

the APA Program. Thus, the tax aspects of the 2003

restructuring will be addressed as part of ongoing federal

income tax audits.

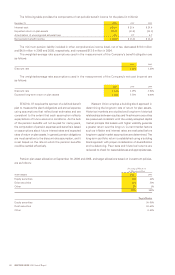

The Company has benefited from the 2003 restructuring

by having its income from certain foreign-to-foreign money

transfer transactions taxed at relatively low foreign tax

rates rather than the U.S. and state combined statutory

tax rate. The amount of taxes attributable to such rate

differential cumulatively totaled approximately $210.8 million

through December 31, 2006.

At December 31, 2006, no provision had been made

for U.S. federal and state income taxes on foreign earnings

of approximately $829.5 million, which are expected to be

reinvested outside the United States indefinitely. Upon

distribution of those earnings in the form of dividends or

otherwise, the Company would be subject to U.S. income

taxes (subject to an adjustment for foreign tax credits),

state income taxes, and withholding taxes payable to

various foreign countries. Determination of the amount of

unrecognized deferred U.S. tax liability is not practicable

because of the complexities associated with its hypothetical

calculation.

Pursuant to a tax allocation agreement signed in

connection with the spin-off from First Data, the Company

and First Data each are liable for taxes imposed on their

respective businesses both prior to and after the spin-off.

Although management of the Company believes that such

taxes have been appropriately apportioned between

First Data and the Company through 2006, subsequent

adjustments may occur as tax filings for such years are

made with all applicable tax jurisdictions and such filings

are finalized.

Also under the tax allocation agreement, with respect

to taxes and other liabilities that could be imposed as a

result of a final determination that is inconsistent with the

anticipated tax consequences (as set forth in the private

letter ruling) in connection with the spin-off (and certain

related transactions) if such transactions do not qualify for

tax-free treatment under the Internal Revenue Code, the

Company will be liable to First Data (i) for any such taxes

or liabilities attributable solely to actions taken by or with

respect to the Company, and (ii) for 50% of any such taxes

or liabilities (A) that would not have been imposed but for

the existence of both an action by the Company and an

action by First Data or (B) where the Company and First

Data each take actions that, standing alone, would have

resulted in the imposition of such taxes or liabilities. The

Company may be similarly liable if it breaches certain

representations or covenants set forth in the tax allocation

agreement. If the Company is required to indemnify First

Data for taxes incurred as a result of the spin-off being

taxable to First Data, it likely would have a material adverse

effect on the Company’s business, financial position and

results of operations.

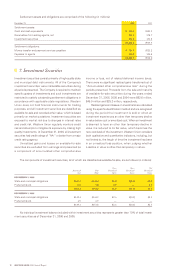

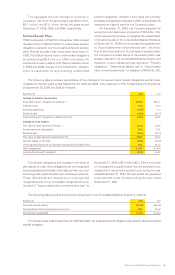

|| 11. Employee Benefit Plans

Defined Contribution Plans

Prior to the spin-off from First Data, eligible full-time

non-union employees of the Company were covered under

a First Data sponsored defined contribution incentive

savings plan. Employees who made voluntary contributions

to this plan, received up to a 3% Western Union matching

contribution, service related contributions of 1.5% to 3%

of eligible employee compensation, certain other additional

employer contributions, and additional discretionary

Company contributions. In addition, First Data provided

non-qualified deferred compensation plans for certain highly

compensated employees. These plans provided tax-deferred

contributions, matching and the restoration of Company

contributions under the defined contribution plans otherwise

limited by IRS or plan limits.

The Company’s Board of Directors approved The

Western Union Company Incentive Savings Plan (“401(k)”)

as of September 29, 2006, covering eligible non-union

employees of Western Union after the spin-off date.

Employees that make voluntary contributions to this plan

receive up to a 4% Western Union matching contribution.

All matching contributions are immediately 100% vested.

The Company also has a 401(k) plan covering its union

employees. Western Union contributes 4% of eligible

employee compensation. Union employees who make

voluntary contributions receive up to a 1.5% Western Union

matching contribution in addition to a $650 per employee

lump-sum contribution per year.

In addition, Western Union’s Board of Directors adopted

a non-qualified deferred compensation plan for highly

compensated employees. The plan provides tax-deferred

contributions, matching and the restoration of Company

matching contributions otherwise limited under the 401(k).