Western Union 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Notes to Consolidated Financial Statements 73

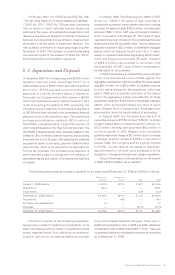

Advertising Costs

Advertising costs are charged to operating expenses as

incurred or at the time the advertising first takes place.

Advertising costs for the years ended December 31, 2006,

2005 and 2004 were $261.4 million, $243.3 million and

$227.9 million, respectively.

Income Taxes

Prior to September 29, 2006, Western Union’s taxable

income was included in the consolidated U.S. federal

income tax return of First Data and also in a number

of state income tax returns, which are or will be filed

as consolidated returns. Western Union files its own

separate tax returns in foreign jurisdictions, and for

periods subsequent to September 29, 2006, files its own

U.S. federal and state income tax returns. Western Union’s

provision for income taxes has been computed as if it were

a separate tax-paying entity for periods prior to the spin-

off from First Data, and federal and state income taxes

payable were remitted to First Data prior to the spin-off.

The state and other income tax provisions represent

applicable taxes payable to the various jurisdictions in which

Western Union operates. Foreign taxes are paid in each

respective jurisdiction locally.

Western Union accounts for income taxes under the

liability method, which requires that deferred tax assets

and liabilities be determined based on the expected future

income tax consequences of events that have been

recognized in the consolidated financial statements.

Deferred tax assets and liabilities are recognized based

on temporary differences between the financial statement

carrying amounts and tax bases of assets and liabilities

using enacted tax rates in effect in the years in which the

temporary differences are expected to reverse.

Foreign Currency Translation

The U.S. dollar is the functional currency for all of Western

Union’s businesses except certain investments located

primarily in the United Kingdom, Ireland and Argentina.

Foreign currency denominated assets and liabilities for

those entities for which the local currency is the functional

currency are translated into U.S. dollars based on exchange

rates prevailing at the end of the period. Revenues and

expenses are translated at average exchange rates prevailing

during the period. The effects of foreign exchange gains

and losses arising from the translation of assets and

liabilities of those entities where the functional currency

is not the U.S. dollar are included as a component of

“Accumulated other comprehensive loss”. Foreign currency

translation gains and losses on assets and liabilities of

foreign operations in which the U.S. dollar is the functional

currency are recognized in operations.

Derivative Financial Instruments

Western Union utilizes derivative instruments to mitigate

foreign currency and interest rate risk. The Company

recognizes all derivative instruments in the “Other assets”

and “Other liabilities” captions in the accompanying

Consolidated Balance Sheets at their fair value. Changes

in the fair value of derivatives, which are designated and

qualify as cash flow hedges in accordance with Statement

of Financial Accounting Standards (“SFAS”) No. 133,

“Accounting for Derivative Instruments and Hedging

Activities,” as amended and interpreted (“SFAS No. 133”),

are recorded in “Accumulated other comprehensive loss”

and reclassified into revenue or interest expense, for foreign

currency and debt related hedges, respectively, in the same

period or periods the hedged item affects earnings, to the

extent the change in the fair value of the instrument is

effective in offsetting the change in fair value of the hedged

item. The portion of the change in fair value that is either

considered ineffective or is excluded from the measure of

effectiveness is recognized immediately in “Derivative

(losses)/gains, net.” Derivative contracts entered into to

reduce the variability related to settlement assets and

obligations, generally with a term of one to three weeks,

are not designated as hedges for accounting purposes

and, as such, changes in their fair value are included in

operating expenses consistent with foreign exchange rate

fluctuations on the related settlement assets and obligations.

All cash flows associated with derivatives are included in

cash flows from operating activities in the Consolidated

Statements of Cash Flows other than those previously

designated as cash flow hedges that were determined to

not qualify for hedge accounting as described in Note 14.

The Company also had certain other foreign

currency swap arrangements with First Data, prior to

September 29, 2006, to mitigate the foreign exchange

impact on certain euro denominated notes receivable with

First Data. These foreign currency swaps did not qualify

for hedge accounting and, accordingly, the fair value changes

of these agreements were reported in the accompanying

Consolidated Statements of Income as “Foreign exchange

effect on notes receivable from First Data, net.” The fair

value of these swaps were recorded in “Receivables from

First Data, net” in the accompanying Consolidated Balance

Sheets and were settled in cash along with the related

notes receivable in connection with the spin-off.

The estimated fair value of the Company’s derivative

financial instruments is based on market and dealer

quotations. Accordingly, these estimated values may not

be representative of actual values that could have been

realized as of December 31, 2006 or 2005 or that will be

realized in the future.