Western Union 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION 2006 Annual Report 60

We are exposed to market risks arising from changes

in market rates and prices, including movements in

foreign currency exchange rates and interest rates. A risk

management program is in place to manage these risks.

Foreign Currency Exchange Rates

We provide money transfer services in more than 200

countries and territories. Foreign exchange risk is managed

through the structure of the business and an active risk

management process. We settle with the vast majority

of our agents in United States dollars or euros. However,

in certain circumstances, we settle in the agents’ local

currencies. We typically require the agent to obtain local

currency to pay recipients. Thus, we generally are not

reliant on international currency markets to obtain and pay

illiquid currencies. The foreign currency exposure that does

exist is limited by the fact that the majority of transactions

are paid within 24 hours after they are initiated. In certain

consumer money transfer transactions involving different

send and receive currencies, we generate revenue

based on the difference between the exchange rate set

by us to the consumer and the rate at which we or our

agents are able to acquire currency helping to further provide

protection against currency fluctuations. Our policy is

not to speculate in foreign currencies and we promptly

buy and sell foreign currencies as necessary to cover our

net payables and receivables which are denominated

in foreign currencies.

We use foreign currency forward contracts to mitigate

risks associated with changes in foreign currency exchange

rates on transactions denominated primarily in the euro

and British pound. We use longer-term foreign currency

forward contracts, generally with maturities of one year

or less, to mitigate some of the risk related to forecasted

revenues, however, during February 2007, we revised

certain guidelines, and are planning to extend the duration

of our foreign currency forward contracts used to mitigate

these risks. We had historically intended to apply hedge

accounting to these derivatives which produced financial

statement results that appeared to be consistent with

the economics of these transactions. However, based

upon an evaluation of our initial hedge documentation, we

determined that our hedge documentation was not adequate

at the inception of the derivative agreements to qualify

for hedge accounting treatment, and accordingly, have

previously restated our financial statements. As a result,

changes in the fair market value of our outstanding

derivative instruments, which are impacted primarily by

fluctuations in the euro, have been recognized in “derivative

(losses)/gains, net” for all derivatives entered into prior to

September 29, 2006. Had these instruments qualified for

hedge accounting treatment, the effective portion of the

changes to the fair value of our derivative instruments

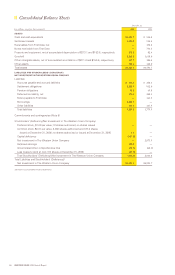

would have been recognized on our consolidated balance

sheets and would not have directly impacted our net income

until such instruments matured. The failure of these

instruments to qualify for hedge accounting treatment

resulted in volatility in our net income for the periods

presented prior to September 30, 2006. For example,

during the years ended December 31, 2006, 2005

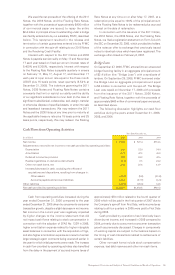

and 2004, we had pre-tax derivative (losses)/gains of

$(21.2) million, $45.8 million and $(30.2) million, respectively.

On September 29, 2006, we re-established our foreign

currency forward positions to qualify for cash flow hedge

accounting. As a result, on a go-forward basis, we anticipate

significantly less volatility in our consolidated statements

of income.

A hypothetical uniform 10% strengthening or weakening

in the value of the United States dollar relative to all

other currencies in which our profits are denominated

would result in a decrease/increase to pretax income of

approximately $27 million as of December 31, 2006. There

are inherent limitations in the sensitivity analysis presented,

primarily due to the assumption that foreign exchange rate

movements are linear and instantaneous. As a result, the

analysis is unable to reflect the potential effects of more

complex market changes that could arise, which may

positively or negatively affect income.

|| Quantitative and Qualitative Disclosures About Market Risk