Western Union 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations 55

Advances from/(to) Affiliates of First Data

Prior to the spin-off, excess cash generated from our

domestic operations that was not required to meet certain

regulatory requirements was paid periodically to First Data

and was reflected as a receivable from First Data. In

addition, First Data and its subsidiaries provided a number

of services on behalf of our businesses, including shared

services, which were reimbursed periodically. The net

payable to and receivable from First Data was a function

of the timing of cash sweeps to First Data net of any

services First Data and its affiliates had provided. These

balances were settled at the time of the spin-off as part

of the dividend to First Data.

Capital Contributed by First Data

in Connection with Acquisitions

In 2005, Western Union received a contribution of capital

from First Data in connection with the acquisition of Vigo.

In 2004, First Data contributed capital in connection with

contingent consideration payments made by First Data in

connection with the acquisitions of Paymap and ECG, both

of which were contributed to Western Union as part of

the spin-off.

Notes Payable to and Receivable from First Data

In connection with the spin-off on September 29, 2006,

funds previously advanced to First Data to finance certain

international acquisitions made by First Data were repaid

to us in cash. These notes were funded primarily through

cash generated from our international operations and

notes payable issued to First Data. As part of the spin-off,

substantially all notes payable and notes receivable to or

from affiliates of First Data were settled in cash.

In 2005 and 2004, we made advances to First Data in

the form of notes of $504.7 million and $270.7 million,

respectively, to finance certain international acquisitions

made by First Data. These notes were funded primarily

through cash generated from our international operations

and notes payable issued to First Data with balances of

$153.6 million at December 31, 2005.

Dividends to First Data

In connection with the spin-off, FFMC paid a $2.4 billion

dividend to First Data in the form of a promissory note that

was repaid immediately following the spin-off, and we paid

an additional $100.0 million to First Data financed through

borrowings under our revolving credit facility as discussed

below. The remaining $453.9 million reflected as a cash

dividend was comprised of cash, consideration for an

ownership interest held by a First Data subsidiary in one

of our agents which had already been reflected as part

of our company, and settlement of net intercompany

receivables (exclusive of certain intercompany notes

discussed above).

In 2005 and 2004, we paid dividends to First Data

from profit generated through operations. The amount

of dividends distributed in each year was impacted by

the cash balances available as a result of loans made

to affiliates.

Proceeds from the Issuance of Borrowings, Net of Debt

Issue Costs / Principal Repayments on Borrowings

During September 2006, FFMC entered into the

Bridge Loan for $2.4 billion, which was refinanced

on November 17, 2006 through the issuance of the

Floating Rate Notes for $500.0 million, the 2011 Notes for

$1.0 billion and the 2036 Notes for $500.0 million, along

with approximately $400 million worth of commercial paper

borrowings, all of which are described in more detail above

under “

—

Financing.”

In addition to the above borrowings, as discussed

further in “—Significant Non-Cash Transactions” below,

we also issued $1.0 billion aggregate principal amount of

the 2016 Notes in connection with the spin-off for which

we received no cash proceeds.

Net Proceeds from the Issuance of Commercial Paper

During November 2006, we established a commercial

paper program pursuant to which we may issue unsecured

commercial paper notes in an amount not to exceed

$1.5 billion outstanding at any time. An initial borrowing

under the commercial paper program of approximately

$400 million was made in connection with the refinancing

of the Bridge Loan described above, of which we

subsequently repaid $75.4 million by the end of 2006.

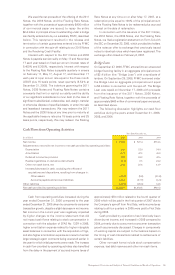

Cash Flows from Financing Activities

Years Ended December 31,

Source (use) (in millions) 2006 2005 2004

Advances from/(to) affiliates of First Data $ 160.2 $(153.2) $ 250.0

Capital contributed by First Data in connection with acquisitions — 369.2 28.7

Notes payable issued to First Data — 400.1 255.0

Repayments of notes payable to First Data (154.5) (246.5) (255.0)

Additions to notes receivable from First Data (7.5) (504.7) (270.7)

Proceeds from repayments of notes receivable from First Data 776.2 18.4 —

Dividends to First Data (2,953.9) (417.2) (659.8)

Proceeds from the issuance of borrowings, net of debt issue costs 4,386.0 — —

Principal payments on borrowings (2,400.0) — —

Net proceeds from the issuance of commercial paper 324.6 — —

Proceeds from net borrowings under credit facilities 3.0 — —

Proceeds from exercise of options 80.8 — —

Cash dividends to public stockholders (7.7) — —

Purchase of treasury shares (19.9) — —

Net cash provided by/(used in) financing activities $ 187.3 $(533.9) $(651.8)