Western Union 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements 75

In February 2007, the FASB issued SFAS No. 159,

“The Fair Value Option for Financial Assets and Liabilities”

(“SFAS No. 159”). SFAS No. 159 provides companies

with an option to report selected financial assets and

liabilities at fair value, and establishes presentation and

disclosure requirements designed to facilitate comparisons

between companies that choose different measurement

attributes for similar types of assets and liabilities. The

new guidance is effective for fiscal years beginning after

November 15, 2007. The Company is currently evaluating

the potential impact of the adoption of SFAS No. 159 on

its financial position and results of operations.

|| 3. Acquisitions and Disposals

In December 2006, the Company acquired SEPSA, which

operates under the brand name Pago Fácil

SM

, for a

total purchase price of $69.5 million, less cash acquired of

$3.0 million. SEPSA provides consumer-to-business

payments to a variety of billers based in Argentina.

Previously, the Company held a 25% interest in SEPSA

which was treated as an equity method investment. As a

result of acquiring the additional 75% ownership, the

Company’s entire investment in and results of operations

of SEPSA have been included in the consolidated financial

statements since the acquisition date. The preliminary

purchase price allocation resulted in $22.4 million of

identifiable intangible assets, a significant portion of

which was attributable to the Pago Fácil service mark. The

identifiable intangible assets were calculated based on the

additional 75% ownership interest acquired, and are being

amortized over two to 25 years. After adjusting the additional

acquired net assets to fair value, goodwill of $48.0 million

was recorded, which is not expected to be deductible for

income tax purposes. The purchase price allocation is

preliminary and subject to change after the valuation of

identifiable assets and certain other assets and liabilities

is finalized.

In October 2005, First Data acquired 100% of GMT

Group, Inc. (“GMT”), the owner of Vigo, a provider of

consumer-to-consumer money transfer services to various

countries, for approximately $369.2 million, including cash

acquired of $20.1 million. GMT was contributed to Western

Union in connection with the spin-off. The results of Vigo’s

operations have been included in the consolidated financial

statements since the acquisition date. The purchase price

allocation resulted in $83.6 million of identifiable intangible

assets, which are being amortized over 3.5 to 11 years,

except for acquired trademarks aggregating $28.6 million,

which are being amortized over 25 years. Goodwill

of $284.4 million was recorded in connection with

the acquisition of GMT, none of which is expected to

be deductible for tax purposes.

In 2004, the Company purchased 30% equity interests

in two of its international money transfer agents. The

aggregate consideration paid during 2004 for these agents

was $42.0 million, net of $5.4 million of holdback reserves

to cover claims arising from the acquisitions, which was

paid in 2005 upon successful resolution of the related

claims. The aggregate purchase price allocation for these

acquisitions resulted in $12.9 million of identifiable intangible

assets, which are being amortized over three to seven

years. Western Union’s investments in these agents are

accounted for under the equity method of accounting.

In August 2003, the Company acquired a 51%

ownership interest in EPOSS Limited (“EPOSS”), a United

Kingdom based seller of prepaid products in Europe, for

$12.2 million, including cash acquired of $9.2 million. In

the fourth quarter of 2005, Western Union recorded a

goodwill impairment charge of $8.7 million due to a change

in strategic direction related to EPOSS. In the second

quarter 2006, the Company sold its majority interest

in EPOSS. The fair value of net assets on disposition

approximated the net book value subsequent to the

recognition of the goodwill impairment charge noted above.

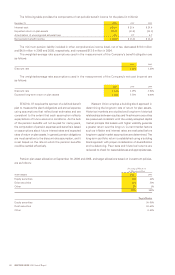

The pro forma impact of all acquisitions on net income

in 2006, 2005 and 2004 was immaterial.

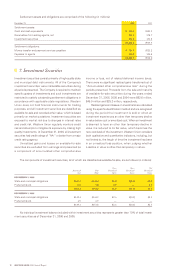

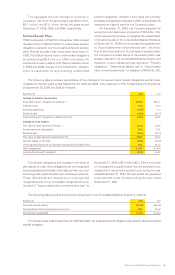

The following table presents changes to goodwill for the years ended December 31, 2006 and 2005 (in millions):

Consumer-to- Consumer-to-

Consumer Business Other Total

January 1, 2005 balance $1,107.6 $195.1 $ 40.9 $1,343.6

Acquisitions 283.1 — — 283.1

Impairments — — (8.7) (8.7)

December 31, 2005 balance $1,390.7 $195.1 $ 32.2 $1,618.0

Acquisitions — 48.0 — 48.0

Purchase price adjustments 1.3 — — 1.3

Disposals — — (19.3) (19.3)

December 31, 2006 balance $1,392.0 $243.1 $ 12.9 $1,648.0

The terms of certain of the Company’s acquisition

agreements provide for additional consideration to be

paid if the acquired entity’s results of operations exceed

certain targeted levels. Such additional consideration

is paid in cash and is recorded as additional purchase

price when targeted levels are achieved. There was no

additional consideration paid in 2005 and 2006. Additional

consideration paid in 2004 totaled $28.7 million. There are

no potential additional consideration payments remaining

as of December 31, 2006.