Western Union 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 Our Business

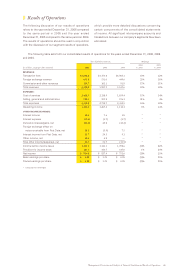

Years Ended December 31, 2006 2005 2004

International

(a) 74%

72% 71%

Domestic

(b) 16%

19% 21%

Mexico

(c) 10%

9% 8%

(a) Represents transactions between and within foreign countries (excluding Canada and Mexico), transactions originated in the United States or Canada destined for foreign countries

and foreign country transactions destined for the United States or Canada. Excludes all transactions between or within the United States and Canada and all transactions to and

from Mexico as reflected in (b) and (c) below.

(b) Represents all transactions between and within the United States and Canada.

(c) Represents all transactions to and from Mexico.

Our other businesses not included in these segments

include Western Union branded money orders available

through a network of third-party agents primarily in the

United States and Canada, and prepaid services. Prepaid

services include a Western Union branded prepaid card

sold through our agent network primarily in the United

States and the Internet, and top-up services for third parties

that allow consumers to pay in advance for mobile phone

and other services.

Consumer-to-Consumer Segment

Individual money transfers from one consumer to another

are the core of our business, representing 84% of our total

consolidated revenues for 2006. We offer consumers a

variety of ways to send money. Although most remittances

are sent in cash at one of our nearly 300,000 agent locations

worldwide, in some countries we also offer the ability to

send money over the Internet or the telephone, using a

credit or debit card. Some agent locations also accept debit

cards to initiate a transaction. We also offer consumers

several options to receive a money transfer. While the vast

majority of transfers are paid in cash at agent locations, in

some places we offer payments directly to the receiver’s

bank account or a stored-value card.

Operations

Our revenue is derived primarily from transaction fees

charged to consumers to transfer money. In certain

consumer money transfer transactions involving different

send and receive currencies, we generate revenue based

on the difference between the exchange rate set by us to

the consumer and the rate at which we or our agents are

able to acquire currency.

In a typical money transfer transaction, a consumer

goes to one of our agent locations, completes a form

specifying, among other things, the name and address of

the recipient, and delivers it, along with the principal amount

of the money transfer and the fee, to the agent. This sending

agent enters the transaction information into our data

processing system and the funds are made available

for payment, usually within minutes. The recipient enters

any agent location in the designated receiving area or

country, presents identification and is paid the transferred

amount. Recipients do not pay a fee (although in limited

circumstances, a tax may be imposed on the payment of

the remittance). We determine the fee paid by the sender,

which generally is based on the principal amount of the

transaction and the locations from and to which the funds

are to be transferred.

We maintain three separate multi-currency, real-time

money transfer processing systems through which a

consumer can transfer money from a location within that

system. Money transfer services are available under

the Western Union, Orlandi Valuta and Vigo brands, at

least one of which is available in each location in the

agent network.

Approximately 85% of our consumer-to-consumer

transactions involve at least one non-United States location.

No individual country outside the United States and Mexico

accounted for more than 10% of the segment’s revenue

for the years ended December 31, 2006, 2005, and 2004.

Mexico, shown separately in the table below, accounted

for the largest single source of foreign country revenue in

the segment. Certain of our agents facilitate a large number

of transactions; however, no individual agent accounted

for greater than 10% of the segment’s revenue during

these periods. The table below presents the geographic

components of consumer-to-consumer revenue for Western

Union, Orlandi Valuta and Vigo as a percentage of the total

segment revenue.

Seasonality

Consumer-to-consumer segment revenue typically increases

sequentially from the first quarter to the fourth quarter

each year and declines from the fourth quarter to the first

quarter of the following year. This seasonal fluctuation is

related to the holiday season in various countries during

the fourth quarter.

Services

We offer money transfer services worldwide. In 2006, over

90% of our consumer-to-consumer transactions were

traditional cash money transfers involving our walk-in

agent locations around the world. In order to enhance the

convenience of our services, we offer a number of options

for sending and receiving funds; however, historically,

demand for in-person, cash money transfers has been the

strongest. The different ways consumers can send or

receive money include the following: