Western Union 2006 Annual Report Download - page 48

Download and view the complete annual report

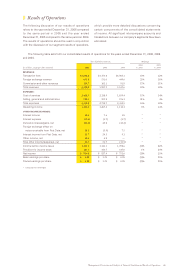

Please find page 48 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION 2006 Annual Report 46

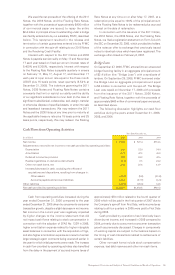

Foreign Exchange Effect on

Notes Receivable from First Data, Net

The revaluation to fair market value of notes receivable

from First Data and the related foreign currency

swap arrangements that were denominated in euros

benefited income before income taxes in the year

ended December 31, 2006 by $10.1 million compared

to a reduction to income before income taxes in the

corresponding period in 2005 by $5.9 million. For the year

ended 2005 compared to 2004, these mark-to-market

valuations resulted in decreased income before income

taxes of $13.4 million. Such fluctuations typically correspond

to changes in the value of the euro.

All notes receivable from First Data, net of notes

payable to First Data, and related foreign currency swap

agreements were settled in cash in connection with the

spin-off on September 29, 2006. Accordingly, no such

amounts will be recognized in the future.

Interest Income from First Data, net

Interest income from First Data, net consists of interest

income earned on notes receivable from First Data, partially

offset by interest incurred on notes payable to First

Data. Interest income from First Data increased for all

periods presented through the spin-off from First Data

on September 29, 2006 due to increased average net

borrowings by First Data from Western Union affiliates.

As part of the spin-off, all remaining notes payable and

notes receivable to or from First Data were settled in cash.

As a result, no interest income from First Data will be

recognized in the future, however, we will earn interest

income on our cash balances as described above.

Other Income, Net

The increase in Other income, net during the years ended

December 31, 2006 and 2005 compared to the previous

corresponding years was driven by higher equity earnings

from equity method investments.

Income Taxes

Our effective tax rates on pretax income were 32%, 31%

and 32% for the years ended December 31, 2006, 2005

and 2004, respectively. The effective tax rate over the

three periods remained relatively constant, with 2005

benefiting slightly from certain state tax adjustments. We

estimate our 2007 tax rate will be approximately 32%

based on current facts and circumstances.

We have established contingency reserves for material,

known tax exposures, including potential tax audit

adjustments with respect to our international operations,

which were restructured in 2003. Our reserves reflect

what we believe to be reasonable assumptions as to the

likely resolution of the issues involved if subject to judicial

review. While we believe that our reserves are adequate

to cover reasonably expected tax risks, there can be no

assurance that, in all instances, an issue raised by a tax

authority will be resolved at a financial cost that does not

exceed our related reserve. Any difference from our position

as recorded in our consolidated financial statements and

the final resolution of a tax issue will be reflected in our

company’s income tax expense in the period during which

the issue is resolved. Such resolution could also affect our

effective tax rate in future periods.

To address certain tax aspects of the 2003 restructuring

of our international operations, discussions were initiated

with the Internal Revenue Service (“IRS”) pursuant to its

Advance Pricing Agreement (“APA”) program. However,

we were notified by the IRS in October 2006 that we will

not be able to conclude an arrangement acceptable to us

through the APA Program. Thus, the tax aspects of the

2003 restructuring will be addressed as part of ongoing

federal income tax audits.

We have benefited from the 2003 restructuring by

having our income from certain foreign-to-foreign money

transfer transactions taxed at relatively low foreign tax

rates rather than the U.S. and state combined statutory

tax rate. The amount of taxes attributable to such rate

differential cumulatively totaled $210.8 million through

December 31, 2006.

Earnings Per Share

During the years ended December 31, 2006, 2005 and

2004, basic earnings per share were $1.20, $1.21 and

$0.98, respectively, and diluted earnings per share were

$1.19, $1.21 and $0.98, respectively. All issued and

outstanding shares of Western Union common stock,

consisting of 100 shares, were held by First Data prior to

September 29, 2006. Accordingly, for all periods presented

prior to the spin-off which occurred on September 29, 2006,

basic and diluted earnings per share were computed using

our basic shares outstanding as of the spin-off date.

Unvested shares of restricted stock are excluded from

basic shares outstanding. Diluted earnings per share

subsequent to September 29, 2006 reflects the potential

dilution that could occur if outstanding stock options on

the presented dates are exercised and shares of restricted

stock have vested. Dilutive shares included in the annual

earnings per share calculation going forward will increase

as such potentially dilutive shares will be outstanding during

the entire periods presented. The repurchase of 0.9 million

shares during the year ended December 31, 2006 had an

anti-dilutive effect on earnings per share. Of the 73.8 million

outstanding options to purchase common shares of our

company, over 60% of those options are held by employees

of First Data.

Diluted earnings per share decreased during the year

ended December 31, 2006 compared to the previous year

due to decreased net income and the increase in diluted

shares outstanding, which was driven by the factors

described in the preceding paragraph and because prior

to the September 29, 2006 spin-off date, there were no

potentially dilutive instruments outstanding. Dilutive earnings

per share increased in 2005 compared to 2004 due to

higher net income.