Western Union 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

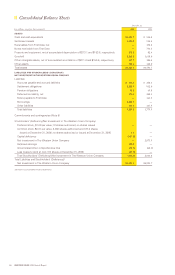

Interest Rates

A portion of our investments are fixed rate interest-bearing

securities, which may include investments made from

cash received from our money transfer business and other

related payment services awaiting redemption. We have

classified these investments as available-for-sale within

settlement assets in the consolidated balance sheets, and

accordingly, record these instruments at their fair market

value with the net unrealized gains and losses, net of the

applicable deferred income tax effect, being added to or

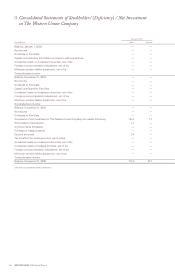

deducted from our total stockholders’ deficiency on our

consolidated balance sheets. As interest rates rise, the fair

market value of these securities will decrease; conversely,

a decrease to interest rates would result in an increase to

the fair market values of the securities.

Currently, the majority of our investments are

floating interest rate investments. Interest income on these

investments will increase and decrease with changes

in the underlying short term interest rates.

As of December 31, 2006, $500 million of our total

$3.3 billion in debt is based on floating interest rates. We

revised certain guidelines in February 2007 and are planning,

through the use of hedges, to increase the percent of

floating rate debt in the future, subject to market conditions.

The interest rate on our floating debt is based on LIBOR

plus 15 basis points and is reset on a quarterly basis.

Additionally, as of December 31, 2006, $324.6 million of

our $3.3 billion in borrowings represented commercial

paper with a weighted average interest rate of approximately

5.4% and a weighted-average initial term of 17 days.

Considering the interest rates associated with our fixed

and floating rate debt, as well as the interest rates on our

commercial paper, our weighted average interest rate on

our borrowings outstanding at December 31, 2006 was

approximately 5.7%.

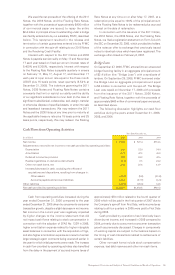

A hypothetical uniform 10% increase in interest rates

would result in a decrease to pretax income of approximately

$4 million annually based on floating rate borrowings that

existed on December 31, 2006. The same 10% increase

in interest rates, if applied to current yields on our cash

and investment balances at December 31, 2006, would

result in an offsetting benefit to pre-tax income of $6 million

annually. There are inherent limitations in the sensitivity

analysis presented, primarily due to the assumption that

interest rate changes would be instantaneous. As a result,

the analysis is unable to reflect the potential effects of

more complex market changes that could arise, which may

positively or negatively affect income. In addition the current

mix of fixed versus floating rate debt and investments and

the level of assets and liabilities will change over time.

Regulatory

Our international agents have the responsibility to maintain

all licenses necessary to provide money transfer services

in their countries and to comply with all local rules,

regulations and licensing requirements. Our money transfer

business is subject to some form of regulation in each of

the 200 countries and territories in which such services

are offered. In some countries, only fully licensed banks

and the national post office are permitted to provide cross-

border money transfer service to the general public.

State, federal and foreign jurisdictions may impose

regulations that could impact our foreign exchange risk by,

among other possibilities, imposing regulations that limit

our ability to obtain the benefit of the exchange rate spread

between wholesale and retail currency rates or imposing

banking moratoriums or other actions that could affect

currency liquidity. We have successfully managed the

risks outlined above in the past and believe that the breadth

and scope of our network makes it unlikely that these risks

will have a material adverse impact on our business.

In those few countries with significant foreign currency

controls, we offer “inbound only” service and do not accept

funds in these countries for remittance abroad. Banking

moratoriums have been very rare and, to date, they have

not had an appreciable impact on our business. When

such a moratorium is imposed by a country, we may

temporarily discontinue its services in that country.

Quantitative and Qualitative Disclosures About Market Risk