Western Union 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 44

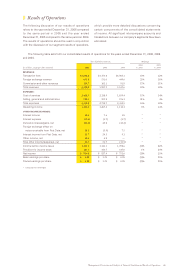

Revenues overview

The following provides highlights of revenue growth while

a more detailed discussion is included in “

—

Segment

Discussion”:

Transaction Fees and Foreign Exchange Revenue

The majority of transaction fees and foreign exchange

revenue are contributed from our consumer-to-consumer

segment, which is discussed in greater detail in “

—

Segment

Discussion.” Transaction fees and foreign exchange

revenue grew 12%, 12% and 13% during the years ended

December 31, 2006, 2005 and 2004 compared to the

previous year, respectively. Increased money transfers at

existing agent locations and, to a lesser extent, new agent

locations contributed to increased transaction volume and

fee revenue for each of those years. Our acquisition

of Vigo in October 2005 contributed $140.5 million in

total revenue during the year ended December 31, 2006

compared to $24.2 million during the year ended

December 31, 2005.

Fluctuations in the exchange ratio between the euro

and the United States dollar have resulted in the following

benefit or reduction to consumer-to-consumer revenue

over the previous year (which represents over 80% of our

consolidated transaction fee and foreign exchange revenue),

net of foreign currency hedges, that would not have

occurred had there been a constant exchange ratio

(in millions):

Year Ended December 31, Benefit /(Reduction)

2006 $11.5

2005 $ (1.4)

2004 $73.4

On a euro adjusted basis and excluding Vigo,

transaction fee and foreign exchange revenue increased

9%, 12% and 11% in 2006, 2005 and 2004 compared to

the respective previous year.

During 2006, Western Union’s business was adversely

impacted by the immigration debate and related activities

in the United States. This controversy around the subject

of immigration and the changes in the approach of various

government entities to the regulation of businesses that

employ or sell to immigrants has created fear and distrust

among some consumers who send money from the United

States to other countries, and among some consumers

who send money within the United States. As a result,

the frequency of money transfer transactions involving

these consumers has decreased and some competitors

have lowered prices and foreign exchange spreads in

certain markets. These and other issues adversely affected

our Mexico and United States domestic businesses, and

to a lesser extent our U.S. outbound businesses in 2006,

and we expect these issues to continue to impact our

businesses in the future. Certain actions taken by the

State of Arizona with respect to Western Union have added

to the uncertainty of some of our consumers. For more

discussion on this matter, refer to the consumer-to-

consumer segment discussion below.

Foreign exchange revenue increased for the years

ended December 31, 2006, 2005 and 2004 over each

respective previous period due to an increase in cross-

currency transactions primarily as a result of strong

growth in international consumer-to-consumer transactions

and the acquisition of Vigo. During the year ended

December 31, 2006, the increase in foreign exchange

revenue was partially offset by reduced foreign exchange

spreads in selected markets.

Commission and Other Revenues

During the years ended December 31, 2006, 2005 and

2004, commission and other revenues increased over

the previous corresponding period primarily as a result

of increased money order commissions due to higher

investment income on money orders pending settlement,

and higher enrollment fee income due to more customers

participating in the Equity Accelerator program. In addition,

2006 commission and other revenue benefited from higher

investment income on higher money transfer and payment

services settlement asset balances.

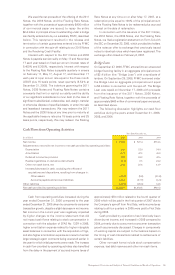

Operating Expenses Overview

The following provides highlights of our operating

expenses:

Cost of Services

Cost of services as a percentage of revenue was 54%,

53% and 52% for the years ended December 31, 2006,

2005 and 2004, respectively.

The majority of the increase in cost of services in

the year ended December 31, 2006 compared to 2005

was attributable to an increase in agent commissions

corresponding to the increase in revenue, and the shift in

our business mix reflecting stronger growth from our

international business, which carries higher cost of services

due to higher commission expense compared to our

domestic and Mexico businesses which carry lower cost

of services. Another factor impacting cost of services as

a percent of revenue is the October 2005 acquisition

of Vigo, which has higher cost of services compared

to Western Union branded money transfers. Higher

stock compensation costs in connection with the adoption

of SFAS No. 123R, and higher employee incentive

compensation expense have also contributed to the increase

in cost of services as a percent of revenue.

The majority of the increase in cost of services for

the year ended December 31, 2005 compared to 2004

was attributable to an increase in agent commissions

corresponding to the increase in revenue. In addition, an

$8.7 million impairment charge was recorded in 2005 due

to a change in strategic direction related to Eposs Limited,

or “Eposs,” a United Kingdom-based seller of cellular

prepaid services. We sold our majority interest in Eposs

on April 28, 2006. We also recognized an $8.2 million

charge in the fourth quarter of 2005 related to an additional

accrual of domestic and international escheatment liabilities

as further discussed in Note 5

—

“Commitments and

Contingencies” to our consolidated financial statements.