Western Union 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 64

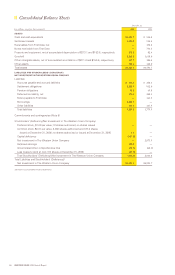

|| Consolidated Balance Sheets

December 31,

(in millions, except per share amounts) 2006 2005

ASSETS

Cash and cash equivalents $1,421.7 $ 510.2

Settlement assets 1,284.2 914.4

Receivables from First Data, net — 192.8

Notes receivable from First Data — 751.5

Property and equipment, net of accumulated depreciation of $213.1 and $183.6, respectively 176.1 82.4

Goodwill 1,648.0 1,618.0

Other intangible assets, net of accumulated amortization of $211.4 and $155.6, respectively 287.7 180.4

Other assets 503.4 342.0

Total assets $5,321.1 $4,591.7

LIABILITIES AND STOCKHOLDERS’ (DEFICIENCY)/

NET INVESTMENT IN THE WESTERN UNION COMPANY

Liabilities:

Accounts payable and accrued liabilities $ 554.8 $ 238.6

Settlement obligations 1,282.5 912.0

Pension obligations 52.9 69.8

Deferred tax liability, net 274.8 248.1

Notes payable to First Data — 163.5

Borrowings 3,323.5 —

Other liabilities 147.4 147.9

Total liabilities 5,635.9 1,779.9

Commitments and contingencies (Note 5)

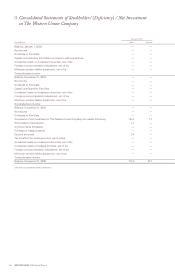

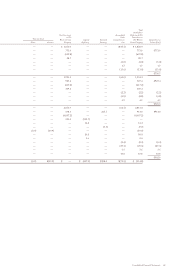

Stockholders’ (Deficiency)/Net Investment in The Western Union Company:

Preferred stock, $1.00 par value; 10 shares authorized; no shares issued — —

Common stock, $0.01 par value; 2,000 shares authorized and 772.0 shares

issued at December 31, 2006; no shares authorized or issued at December 31, 2005 7.7 —

Capital deficiency (437.1) —

Net investment in The Western Union Company — 2,873.9

Retained earnings 208.0 —

Accumulated other comprehensive loss (73.5) (62.1)

Less treasury stock at cost, 0.9 shares at December 31, 2006 (19.9) —

Total Stockholders’ (Deficiency)/Net Investment in The Western Union Company (314.8) 2,811.8

Total Liabilities and Stockholders’ (Deficiency)/

Net Investment in The Western Union Company $5,321.1 $4,591.7

See Notes to Consolidated Financial Statements.