Western Union 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Management’s Discussion and Analysis of Financial Condition and Results of Operations 39

You should read the following discussion in conjunction

with the consolidated financial statements and the notes

to those statements included elsewhere in this Annual

Report. This Annual Report contains certain statements

that are forward-looking within the meaning of the Private

Securities Litigation Reform Act of 1995. Certain statements

contained in the Management’s Discussion and Analysis

of Financial Condition and Results of Operations are forward-

looking statements that involve risks and uncertainties.

The forward-looking statements are not historical facts,

but rather are based on current expectations, estimates,

assumptions and projections about our industry, business

and future financial results. Our actual results could differ

materially from the results contemplated by these forward-

looking statements due to a number of factors, including

those discussed in other sections of this Annual Report.

See “Forward-Looking Statements.”

|| Overview

We are a leading provider of money transfer services,

operating in two business segments:

||

Consumer-to-consumer money transfer services,

provided primarily through a global network of third-

party agents using our multi-currency, real-time

money transfer processing systems. This service

is available for both international cross-border

transactions

—

that is, the transfer of funds from one

country to another

—

and intra-country transfers

—

that

is, money transfers from one location to another in

the same country.

|| Consumer-to-business payment services, which

allow consumers to send funds to businesses and

other organizations that receive consumer payments,

including utilities, auto finance companies, mortgage

servicers, financial service providers and government

entities (all sometimes referred to as “billers”)

through our network of third-party agents and various

electronic channels.

Businesses not considered part of the segments

described above are categorized as “Other” and generated

approximately 2% of our total consolidated revenue for

the year ended December 31, 2006.

The consumer-to-consumer money transfer service

is available through an extensive network of agent locations

that offer Western Union services around the world. Some

of our agent locations only pay out and do not send money.

In addition to our agent locations, we are expanding the

ability of consumers to send money through other channels,

such as our Internet site, westernunion.com, and the

telephone. Consumer-to-consumer money transfer service

is available through the Western Union,

®

Orlandi Valuta

®

and VigoSM brands, and includes locations offering any of

our three brands.

The consumer-to-business service allows consumers

to transfer money to a biller. This service is available at

many of our Western Union agent locations and in some

instances through the Internet or by telephone primarily

in the United States. In December 2006, we acquired the

remaining 75% interest in Servicio Electrónico de Pago

S.A., and related entities (“SEPSA”), a walk in bill payment

company based in Argentina with more than 3,300 locations.

Prior to the acquisition, we held a 25% interest in SEPSA.

Factors that we believe are important to our long-term

success include international growth by expanding and

diversifying our consumer-to-consumer global distribution

network, building our brands, enhancing the consumer

experience, expanding the channels by which consumers

can send or receive money and diversifying our consumer-

to-consumer service offerings, expanding into new biller

and other business and government relationships, and

expanding the international presence of our consumer-to-

business offerings. Significant factors affecting our financial

position and results of operations include:

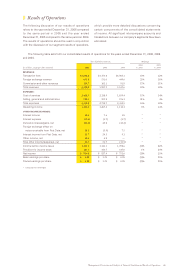

|| Transaction volume is the primary generator of

revenue in our businesses. Transaction volume in

our consumer-to-consumer segment is affected by,

among other things, the size of the international

migrant population and individual needs to transfer

funds in emergency situations. We anticipate the

demand for money transfer services will be strong

as individuals continue to migrate to countries outside

of their countries of origin. A reduction in the size

of the migrant population, interruptions in migration

patterns or reduced employment opportunities

including those resulting from any changes in

immigration laws, economic development patterns

or political events, could adversely affect our

transaction volume. For example, during 2006, the

United States to Mexico and United States domestic

businesses, and to a lesser extent United States

outbound businesses, were adversely impacted by

the immigration debate and related activities in the

United States. This controversy around the subject

of immigration and the changes in the approach of

various government entities to the regulation of

businesses that employ or sell to immigrants has

created fear and distrust among some consumers

in the United States. As a result, the frequency of

money transfer transactions involving these consumers

has decreased and some competitors have lowered

prices and foreign exchange spreads in certain markets.

These and other issues adversely affected our

Mexico and United States domestic businesses,

and to a lesser extent our U.S. outbound business

in 2006, and we expect them to continue to impact

our businesses in the future. Certain actions taken

by the State of Arizona with respect to money transfer

service providers have added to the uncertainty of

some of our consumers. For more discussion on

this matter, refer to the consumer-to-consumer

segment discussion below.