Western Union 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements 81

|| 10. Income Taxes

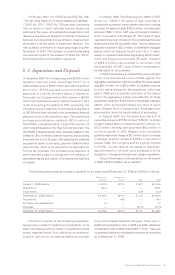

The components of pretax income are as follows (in millions):

Year Ended December 31, 2006 2005 2004

Components of pretax income:

Domestic $ 707.1 $ 801.9 $ 689.7

Foreign 628.0 542.2 408.9

$1,335.1 $1,344.1 $1,098.6

The provision for income taxes is as follows (in millions):

Year Ended December 31, 2006 2005 2004

Federal $331.1 $338.0 $276.1

State and local 34.5 29.1 35.7

Foreign 55.5 49.6 35.2

$421.1 $416.7 $347.0

The Company’s effective tax rates differ from statutory rates as follows:

Year Ended December 31, 2006 2005 2004

Federal statutory rate 35.0% 35.0% 35.0%

State income taxes, net of federal income tax benefits 2.0% 2.0% 2.0%

Foreign rate differential (6.3)% (5.8)% (4.7)%

Federal tax credits (0.3)% (0.4)% (0.5)%

Other 1.1% 0.2% (0.2)%

Effective tax rate 31.5% 31.0% 31.6%

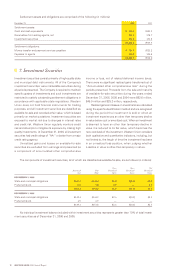

Western Union’s income tax provision consists of the following components (in millions):

Year Ended December 31, 2006 2005 2004

Current:

Federal $314.0 $326.4 $228.9

State and local 33.1 26.0 30.7

Foreign 61.1 39.4 39.8

Total current taxes 408.2 391.8 299.4

Deferred:

Federal 17.1 11.6 47.2

State and local 1.4 3.1 5.0

Foreign (5.6) 10.2 (4.6)

Total deferred taxes 12.9 24.9 47.6

$421.1 $416.7 $347.0

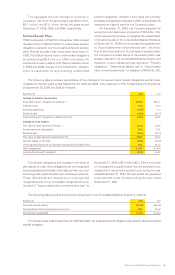

Deferred tax assets and liabilities are recognized for the expected tax consequences of temporary differences

between the book and tax bases of Western Union’s assets and liabilities. The following table outlines the principal

components of deferred tax items (in millions):

December 31, 2006 2005

Deferred tax assets related to:

Reserves and accrued expenses $ 24.0 $ 15.6

Pension obligations 21.6 25.6

Deferred revenue 6.2 6.2

Other 8.3 8.4

Total deferred tax assets 60.1 55.8

Deferred tax liabilities related to:

Property, equipment and intangibles 325.2 292.8

Other 9.7 11.1

Total deferred tax liabilities 334.9 303.9

Net deferred tax liability $274.8 $248.1