Western Union 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 70

Earnings Per Share

The calculation of basic earnings per share excludes dilution

and is computed by dividing net income available to common

stockholders by the weighted average number of shares

of common stock outstanding for the period. Prior to

September 29, 2006, all outstanding shares of Western

Union were owned by First Data. Accordingly, for all

periods prior to the completion of the Distribution on

September 29, 2006, basic and diluted earnings per share

are computed using Western Union’s shares outstanding

as of that date. Unvested shares of restricted stock are

excluded from basic shares outstanding. Diluted earnings

per share subsequent to September 29, 2006 reflects the

potential dilution that could occur if outstanding stock

options at the presented date are exercised and shares

of restricted stock have vested and shares have been

transferred in settlement of stock unit awards.

Prior to completion of the Distribution, First Data

converted options, restricted stock awards, and restricted

stock units held by First Data and Western Union employees.

For First Data employees, one replacement First Data

option and one Western Union option was distributed for

every First Data option held prior to the spin-off. For Western

Union employees, outstanding First Data options were

converted to substitute options to purchase Western Union

common stock at a conversion ratio of 2.1955 options to

purchase Western Union common stock for every option

to purchase First Data common stock prior to the spin-off.

The new awards maintained both the pre-conversion

aggregate intrinsic value of each award and the ratio of

the exercise price per share to the fair market value per

share as of the spin-off date. Refer to Note 16, “Stock

Compensation Plans,” for a more detailed discussion of

our stock-based compensation plans.

As of December 31, 2006, there were 4.9 million

outstanding options to purchase shares of Western Union

stock excluded from the diluted earnings per share calculation,

as the exercise price of the options exceeded or was equal

to the Company’s stock price.

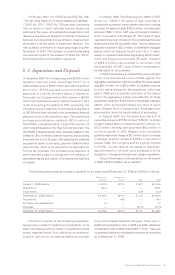

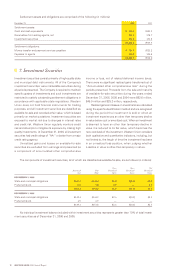

The following table provides the calculation of diluted weighted average shares outstanding, and only considers the

potential dilution for stock options, restricted stock awards and restricted stock units for the period subsequent to the

spin-off date of September 29, 2006 (in millions):

For the Year Ended December 31, 2006 2005 2004

Basic weighted-average shares 764.5 763.9 763.9

Common stock equivalents existing after the spin-off 4.1 — —

Diluted weighted-average shares outstanding 768.6 763.9 763.9

Fair Value of Financial Instruments

Carrying amounts for Western Union financial instruments,

including cash and cash equivalents, settlement assets

(other than investment securities), settlement obligations,

borrowings under the commercial paper program, and

revolving and other short-term notes payable, approximate

fair value due to their short maturities. Investment

securities, included in settlement assets, are carried at

fair market value and are considered available for sale

(Note 7). Fixed and floating rate notes are carried at their

discounted notional amounts. The fair market values of

fixed and floating rate notes disclosed in Note 15 are

based on market quotations.

Cash and Cash Equivalents

Highly liquid investments (other than those included in

settlement assets) with maturities of three months or less

at the date of purchase (that are readily convertible to cash)

are considered to be cash equivalents and are stated at

cost, which approximates market value.

Western Union maintains cash and cash equivalent

balances with various financial institutions. Western Union

limits the concentration of its cash and cash equivalents

with any one institution; however, such balances often

exceed United States federal insurance limits. Western

Union periodically evaluates the credit worthiness of these

institutions to minimize risk.