Western Union 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.99

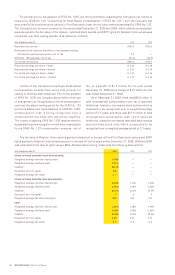

|| Controls and Procedures

Our management, under the supervision and with the

participation of the Principal Executive Officer and Chief

Financial Officer, have evaluated the effectiveness of our

controls and procedures related to our reporting and

disclosure obligations as of December 31, 2006, which is

the end of the period covered by this Annual Report. Based

on that evaluation, and except as described below, the

principal executive officer and chief financial officer have

concluded that the disclosure controls and procedures are

sufficient to provide that (a) material information relating

to us, including our consolidated subsidiaries, is made

known to these officers by our other employees and

employees of our consolidated subsidiaries, particularly

material information related to the period for which this

periodic report is being prepared; and (b) this information

is recorded, processed, summarized, evaluated and

reported, as applicable, within the time periods

specified in the rules and forms of the Securities and

Exchange Commission. We previously identified a material

weakness and restated our financial statements for the

quarters ended March 31, 2006 and June 30, 2006 and

the years ended December 31, 2005, 2004, and 2003

included in our Registration Statement on Form 10, as

amended. Based upon an evaluation of our initial

documentation of hedging arrangements in accordance

with Statement of Financial Accounting Standards No. 133,

“Accounting for Derivative Instruments and Hedging

Activities,” as amended by SFAS No. 138 and SFAS

No. 149 (“SFAS No. 133”), we concluded that our foreign

exchange forward contracts did not qualify for cash flow

hedge accounting since the initial documentation with

respect to these instruments did not meet the requirements

of SFAS No. 133.

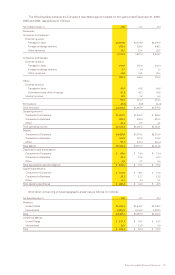

Under the direction of our Chief Executive Officer and

our then Co-Principal Financial Officers in September 2006,

we implemented new internal control procedures to improve

the effectiveness of our review over accounting for

derivative financial instruments and to ensure that these

transactions are accounted for in accordance with generally

accepted accounting principles in the United States of

America. These remedial actions include an additional

review by a combination of internal and external personnel

of hedging strategies and related documentation prior to

implementing new or modified strategies, processes or

documentation to ensure hedge accounting is appropriately

applied with respect to SFAS No. 133. In addition, we have

revised and improved the documentation required at the

initiation of a derivative instrument and also during

the required periodic reviews. We will continue to monitor

the effectiveness of these processes, procedures and

controls, and will make any further changes as management

determines appropriate.

Except as described above, there were no changes

that oc c urred dur ing t he f i scal quar ter e nded

December 31, 2006 that have materially affected, or

are reasonably likely to materially affect, our internal

controls over financial reporting.

Controls and Procedures