Western Union 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 54

Capital Expenditures

Total aggregate payments capitalized for purchases of

property and equipment, software development and contract

costs were $202.3 million, $65.0 million, and $49.5 million

in 2006, 2005, and 2004, respectively. Amounts capitalized

for contract costs relate to initial payments for new and

renewed agent contracts and vary depending on the timing

of when new contracts are signed and existing contracts

are renewed. In 2006, we purchased an office building

and made investments in our information technology

infrastructure in connection with being a stand alone com-

pany which contributed to the increase in property and

equipment for the year ended December 31, 2006.

In addition, during 2006, we renewed and entered into

certain large strategic agent contracts for which initial

payments were made that drove the increase in capitalized

contract costs.

The decrease in software development costs during

2005 compared to 2004 relates primarily to the timing of

internally developed software projects. We estimate that

capital expenditures in 2007 will be between $200 million

and $250 million.

Notes Receivable Issued to Agents and

Repayments of Notes Receivable Issued to Agents

From time to time, we make advances and loans to agents.

In 2006, we signed a six year agreement with one of

our existing agents which included a four year loan of

$140.0 million to the agent, of which $20.0 million was

repaid by the agent during 2006. The terms of the loan

agreement require that a percentage of commissions

earned by the agent (52% in 2007, 61% in 2008 and

64% in 2009) be withheld by us as repayment of the loan

and the agent remains obligated to repay the loan if

commissions earned are not sufficient. The loan receivable

was recorded in “Other assets” in our consolidated balance

sheet as of December 31, 2006. We impute interest

on this below-market rate note receivable and have

recorded this note net of a discount of $37.8 million as of

December 31, 2006.

Acquisition of Businesses, Net of Cash Acquired

and Contingent Purchase Consideration Paid

In December 2006, we acquired SEPSA for a total purchase

price of $69.5 million, less cash acquired of $3.0 million

resulting in a net cash outflow of $66.5 million. During

2005, First Data acquired 100% of Vigo for a total purchase

price of $369.2 million, net of cash acquired of $20.1 million

resulting in a net cash outflow of $349.1 million. In 2004,

contingent consideration payments were made by First

Data in connection with the acquisitions of Paymap Inc.,

or “Paymap,” and E Commerce Group, Inc., or “ECG,”

during the second quarter of 2002. First Data contributed

Vigo, Paymap and ECG to us as part of the spin-off.

Cash Received/(Paid ) on Maturity

of Foreign Currency Forwards

Amounts received or paid on maturity of our foreign

currency forward contracts that do not qualify as hedges

in accordance with applicable accounting rules have been

classified in the consolidated statements of cash flows as

investing activities. Prior to September 29, 2006, we did

not have any forward contracts that qualified as hedges,

and accordingly, all realized gains and losses on these

contracts have been reflected in investing activities prior

to that date. On September 29, 2006, we re-established

our foreign currency forward positions to qualify for cash

flow hedge accounting. As a result, on a go-forward basis,

we anticipate the amounts reflected in investing activities

related to foreign currency forwards will be minimal. “Cash

received/(paid) on maturity of foreign currency forwards”

does not include amounts realized on forward contracts

intended to mitigate exposures on settlement activities of

our money transfer business, which along with the realized

gains and losses on the related settlement assets and

obligations, are reflected in operating activities.

Purchase of Equity Method Investments

In 2004, we purchased 30% interests in two of our

international money transfer agents. The aggregate purchase

price paid was $42.0 million, net of $5.4 million of holdback

reserves to cover claims arising from the acquisitions.

The holdback reserves were paid in 2005.

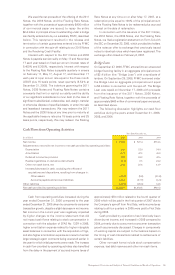

Cash Flows from Investing Activities

Years ended December 31,

Source (use) (in millions) 2006 2005 2004

Capitalization of contract costs $(124.1) $ (22.5) $ (7.3)

Capitalization of software development costs (14.4) (7.7) (15.7)

Purchases of property and equipment (63.8) (34.8) (26.5)

Notes receivable issued to agents (140.0) (8.4) —

Repayments of notes receivable issued to agents 20.0 — —

Acquisition of businesses, net of cash acquired and

contingent purchase consideration paid (66.5) (349.1) (28.7)

Cash received/(paid) on maturity of foreign currency forwards 4.1 (0.5) (23.2)

Purchase of equity method investments — (5.4) (42.0)

Net cash used in investing activities $(384.7) $(428.4) $(143.4)