Western Union 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Notes to Consolidated Financial Statements 71

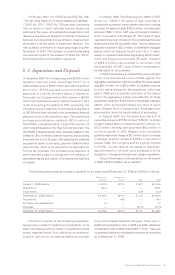

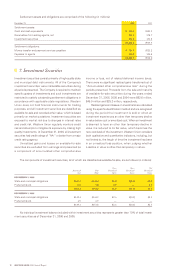

Allowance for Doubtful Accounts

Western Union records an allowance for doubtful accounts

when it is probable that the related receivable balance

will not be collected based on its history of collection

experience, known collection issues, such as agent

suspensions and bankruptcies, and other matters the

Company identifies in its routine collection monitoring. The

allowance for doubtful accounts was $7.3 million and

$8.4 million at December 31, 2006 and 2005, respectively.

Settlement Assets and Obligations

Settlement assets represent funds received or to be

received from agents for unsettled money transfers and

consumer payments. Western Union records corresponding

settlement obligations relating to amounts payable under

money transfer and payment service arrangements.

Settlement assets are comprised of cash and cash

equivalents, receivables from selling agents and investment

securities. Cash received by Western Union agents generally

becomes available to Western Union within one week after

initial receipt by the agent. Cash equivalents consist of

short-term time deposits, commercial paper and other

highly liquid investments. Receivables from selling agents

represent funds collected by such agents, but in transit to

Western Union. Western Union has a large and diverse

agent base, thereby reducing the credit risk of the Company

from any one agent. In addition, Western Union performs

ongoing credit evaluations of its agents’ financial condition

and credit worthiness. See Note 7 for information concerning

the Company’s investment securities.

Settlement obligations consist of money transfer

and payment service payables and payables to agents.

Money transfer payables represent amounts to be paid to

transferees when they request their funds. Most agents

typically settle with transferees first and then obtain

reimbursement from Western Union. Due to the agent

funding and settlement process, payables to agents

represent amounts due to agents for money transfers

that have been settled with transferees. Payment service

payables represent amounts to be paid to utility companies,

collection agencies, finance companies, mortgage servicers,

government entities and others.

Property and Equipment

Property and equipment are stated at cost, except for

acquired assets which are recorded at fair market value

under purchase accounting rules. Depreciation is computed

using the straight-line method over the lesser of the

estimated life of the related assets (generally three to

10 years, for equipment, furniture and fixtures, and

30 years for buildings) or the lease term. Maintenance

and repairs, which do not extend the useful life of the

respective assets, are charged to expense as incurred.

Deferred Customer Set Up Costs

The Company capitalizes direct incremental costs not to

exceed related deferred revenues associated with the

enrollment of customers in the Equity Accelerator program,

a service that allows consumers to complete automated

clearing house (“ACH”) transactions to make recurring

mortgage payments. Deferred customer set up costs,

included in “Other assets” in the Consolidated Balance

Sheets, are amortized to “Cost of services” in the

Consolidated Statements of Income over the length of the

customer’s expected participation in the program, generally

five to seven years. Actual customer attrition data is

assessed at least annually and the amortization period is

adjusted prospectively.

Goodwill

Goodwill represents the excess of purchase price over the

fair value of tangible and other intangible assets acquired,

less liabilities assumed arising from business combinations.

The Company’s annual goodwill impairment test did not

identify any goodwill impairment in 2006 or 2004; however,

Western Union recorded a goodwill impairment charge of

$8.7 million in 2005 due to a change in strategic direction

relating to one of its majority owned prepaid businesses

(Note 3). The majority of goodwill on Western Union’s

Consolidated Balance Sheets arose in connection with

FFMC’s acquisition of WUFSI in November 1994. FFMC

was acquired by First Data in October 1995.

Other Intangible Assets

Other intangible assets primarily consist of contract

costs (primarily amounts paid to agents in connection with

establishing and renewing long-term contracts) and

software. Other intangible assets are amortized on a

straight-line basis over the length of the contract or benefit

periods. Included in “Cost of services” in the Consolidated

Statements of Income is amortization expense of

approximately $68.7 million, $47.5 million and $45.2 million

for the years ended December 31, 2006, 2005 and 2004,

respectively.

The Company capitalizes initial payments for new and

renewed agent contracts to the extent recoverable through

future operations, contractual minimums and/or penalties

in the case of early termination. The Company’s accounting

policy is to limit the amount of capitalized costs for a

given contract to the lesser of the estimated ongoing future

cash flows from the contract or the termination fees the

Company would receive in the event of early termination

of the contract.

The Company develops software that is used in providing

services. Software development costs are capitalized

once technological feasibility of the software has been

established. Costs incurred prior to establishing technological

feasibility are expensed as incurred. Technological feasibility

is established when the Company has completed all

planning, designing, coding and testing activities that are

necessary to determine that a product can be produced

to meet its design specifications, including functions,

features and technical performance requirements.

Capitalization of costs ceases when the product is available

for general use. Software development costs and purchased

software are amortized over a term of three to five years.