Western Union 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

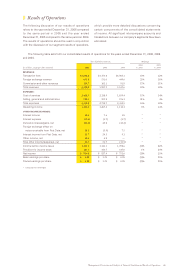

Management’s Discussion and Analysis of Financial Condition and Results of Operations 53

We used the net proceeds of the offering of the 2011

Notes, the 2036 Notes, and the Floating Rate Notes,

together with the proceeds of approximately $400 million

of commercial paper we issued, to repay the entire

$2.4 billion in principal amount outstanding under a bridge

loan facility entered into by our subsidiary FFMC, described

below. This repayment resulted in the release and

termination of certain guarantees entered into by FFMC

in connection with the spin-off relating to our 2016 Notes

and the Revolving Credit Facility.

Interest with respect to the 2011 Notes and 2036

Notes is payable semiannually on May 17 and November

17 each year based on fixed per annum interest rates of

5.400% and 6.200%, respectively. Interest with respect

to the Floating Rate Notes is payable quarterly in arrears

on February 17, May 17, August 17, and November 17

each year at a per annum rate equal to the three month

LIBOR plus 15 basis points, reset quarterly (5.52% at

December 31, 2006). The indenture governing the 2011

Notes, 2036 Notes and Floating Rate Notes contains

covenants that limit or restrict our ability and the ability

of our significant subsidiaries to incur debt (in the case of

significant subsidiaries), collateralize, sell, assign, transfer

or otherwise dispose of specified assets, or enter into sale

and leaseback transactions. We may redeem the 2011

Notes and the 2036 Notes at any time prior to maturity at

the applicable treasury rate plus 15 basis points and 25

basis points, respectively. We may redeem the Floating

Rate Notes at any time on or after May 17, 2007, at a

redemption price equal to 100% of the principal amount

of the Floating Rate Notes to be redeemed plus accrued

interest on the date of redemption.

In connection with the issuance of the 2011 Notes,

the 2016 Notes, the 2036 Notes, and the Floating Rate

Notes, we filed a registration statement on Form S-4 with

the SEC on December 22, 2006, which provided the holders

of the notes an offer to exchange their previously issued

notes for identical notes which have been registered. The

exchange offer closed on February 6, 2007.

Bridge Loan

On September 27, 2006, FFMC entered into an unsecured

bridge financing facility in an aggregate principal amount

of $2.4 billion (the “Bridge Loan”) with a syndicate of

lenders. On September 29, 2006, FFMC borrowed under

the Bridge Loan an aggregate principal amount equal

to $2.4 billion in connection with the spin-off. The Bridge

Loan was repaid on November 17, 2006 with proceeds

from the issuance of the 2011 Notes, 2036 Notes,

and Floating Rate Notes, together with the proceeds of

approximately $400 million of commercial paper we issued,

as described above.

The following discussion highlights our cash flow

activities during the years ended December 31, 2006,

2005, and 2004.

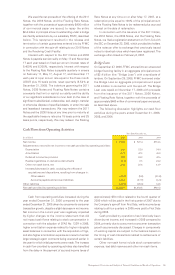

Cash Flows from Operating Activities

Years Ended December 31,

(in millions) 2006 2005 2004

Net income $ 914.0 $ 927.4 $751.6

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 34.8 32.0 34.0

Amortization 68.7 47.5 45.2

Deferred income tax provision 12.9 24.9 47.6

Realized (gain)/loss on derivative instruments (4.1) 0.5 23.2

Other non-cash items, net 47.6 25.8 13.9

Increase/(decrease) in cash, excluding the effects of

acquisitions and dispositions, resulting from changes in:

Other assets (60.7) (8.8) (13.8)

Accounts payable and accrued liabilities 123.2 (17.9) (6.3)

Other liabilities (27.5) (28.6) 34.8

Net cash provided by operating activities $1,108.9 $1,002.8 $930.2

Cash from operating activities increased during the

year ended December 31, 2006 compared to the year

ended December 31, 2005 driven by consumer-to-consumer

transaction growth, despite a slight decrease in net income.

Net income in the current year was negatively impacted

by higher charges to the income statement that did

not impact cash flows relating to stock compensation in

connection with the adoption of SFAS No. 123R in 2006,

higher amortization expense related to higher intangible

asset balances in connection with the acquisition of Vigo,

and also higher amortization expense as a result of certain

large strategic agent contracts being executed earlier in

the year for which initial payments were made. The increase

in cash flow provided by operating activities also benefited

from the delay in the payment of accrued income taxes of

approximately $70 million related to the fourth quarter of

2006 which will be paid in the first quarter of 2007 due to

the Company’s spin-off from First Data, while income taxes

relating to all four quarters in 2005 were paid to First Data

during 2005.

Cash provided by operations has historically been

driven by net income, and increased in 2005 compared to

2004, primarily due to consumer-to-consumer transaction

growth as previously discussed. Changes in components

of working capital are subject to fluctuations based on

the timing of cash transactions related to settlements of

certain liabilities.

Other non-cash items include stock compensation

expense, bad debt reserves and other non-cash items.