Western Union 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Notes to Consolidated Financial Statements 77

|| 5. Commitments and

Contingencies

In the normal course of business, Western Union is subject

to claims and litigation. Management of Western Union

believes such matters involving a reasonably possible

chance of loss will not, individually or in the aggregate,

result in a materially adverse effect on Western Union’s

financial position, results of operations or cash flows.

Western Union accrues for loss contingencies as they

become probable and estimable.

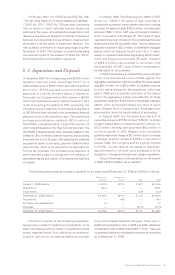

On August 21, 2006, the Interregional Inspectorate

No. 50 of the Federal Tax Service of the Russian Federation

for the City of Moscow (“Tax Inspectorate”) issued a tax

audit report to OOO Western Union MT East (“MT East”),

an indirect wholly owned subsidiary of the Company,

asserting claims for the underpayment of Russian

Value Added Taxes (“VAT”) related to the money transfer

activities of MT East in Russia during 2003 and 2004.

On October 24, 2006, the Tax Inspectorate issued its final

decision for tax assessment and tax demand notices to

MT East for approximately $20 million, including a 20%

penalty and applicable interest to date, which assessment

MT East challenged in the applicable Russian court. The

court has issued its ruling in favor of MT East holding

that the services provided in Russia by MT East qualify

as banking services which are not subject to VAT.

The Tax Inspectorate may appeal this ruling. As of

December 31, 2006, the Company has not accrued any

potential loss or associated penalties and interest based

on the ruling issued by the court and the Company’s belief

that such services qualify as banking services and are not

subject to tax.

Western Union is subject to unclaimed or abandoned

property (escheat) laws in the United States and abroad.

These laws require the Company to turn over to certain

government authorities the property of others held by

the Company that has been unclaimed for a specified

period of time, such as unredeemed money transfers.

The Company holds property subject to escheat laws and

the Company has an ongoing program to comply with the

laws. The Company is subject to audits with regard to its

escheatment practices.

In 2002, Affiliated Computer Services (“ACS”) notified

First Data of its intent to audit First Data’s escheatment

practices (and those of all its subsidiaries) on behalf of

19 states (the “ACS States”). The ACS States have

subsequently increased to 43 states. However, the ACS

States have agreed to allow First Data and its subsidiaries

to conduct an internal examination of their escheatment

practices utilizing third-party experts. First Data has

independently entered into Voluntary Disclosure Agreements

with four other states (the “VDA States”). Like the ACS

States, the VDA States agreed to allow First Data and

its subsidiaries to conduct their own internal review in

place of an audit by the states.

First Data completed the majority of its internal review

in December 2005. As a result of that review, and in addition

to amounts already recorded, the Company recognized an

$8.2 million pretax charge, reflected in “Cost of Services”

in the Consolidated Statements of Income, in the fourth

quarter of 2005 for domestic and international escheatment

liabilities (portions of this charge are not scheduled to be

remitted until periods beyond 2006). Western Union

and First Data have agreed that First Data will continue

discussions with the ACS States and VDA States on behalf

of Western Union and is authorized to settle the escheat

liabilities within specified parameters.

Western Union has completed its internal review and

is in the final discussions of the results thereof with the

ACS States and the VDA States. Any difference between

the amounts accrued by the Company and those claimed

by a state or foreign jurisdiction will be reflected in the

periods in which any resolutions occur.

The Company has $55.9 million in outstanding letters

of credit and bank guarantees at December 31, 2006 with

expiration dates through 2011, certain of which contain a

one-year renewal option. The letters of credit and bank

guarantees are primarily held in connection with lease

arrangements and agent settlement agreements. The

Company expects to renew the letters of credit prior to

expiration in most circumstances.

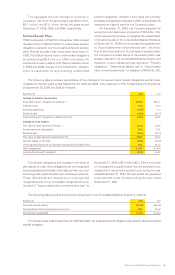

Pursuant to the Separation and Distribution Agreement

with First Data in connection with the spin-off (see

Note 1), First Data and the Company are each liable for,

and agreed to perform, all liabilities with respect to their

respective businesses. In addition, the separation and

distribution agreement also provides for cross-indemnities

principally designed to place financial responsibility for the

obligations and liabilities of the Company’s business with

the Company and financial responsibility for the obligations

and liabilities of First Data’s retained businesses with

First Data. The Company also entered into a tax allocation

agreement that sets forth the rights and obligations of First

Data and the Company with respect to taxes imposed on

their respective businesses both prior to and after the

spin-off as well as potential tax obligations for which the

Company may be liable in conjunction with the spin-off

(see Note 10).

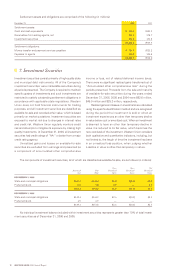

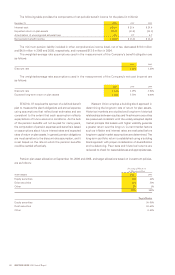

|| 6. Settlement Assets and

Settlement Obligations

Settlement assets represent funds received or to be

received from agents for unsettled money transfers and

consumer payments. Western Union records corresponding

settlement obligations relating to amounts payable under

money transfer and payment service arrangements. The

difference in the aggregate amount of settlement assets

and obligations is due to cumulative unrealized net investment

gains and losses.