Western Union 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Notes to Consolidated Financial Statements 69

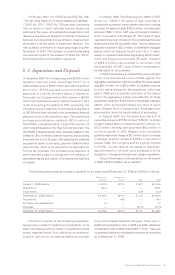

The remaining approximately $602 million reflected

as a dividend to First Data was comprised of cash,

consideration for an ownership interest held by a First Data

subsidiary in one of the Company’s agents which had

already been reflected as part of the Company, settlement

of net intercompany receivables (exclusive of certain

intercompany notes discussed in the following paragraph),

and transfers of certain liabilities, net of assets.

The Company also settled certain intercompany notes

receivable and payable with First Data along with related

interest and currency swap agreements associated with

such notes as part of the spin-off. The net settlement

of the principal and related swaps resulted in a net cash

inflow of $724.0 million to the Company’s cash flows from

financing activities. The net settlement of interest on such

notes receivable and payable of $40.7 million was reflected

in cash flows from operating activities in the Company’s

Consolidated Statement of Cash Flows.

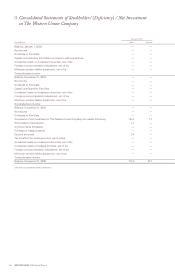

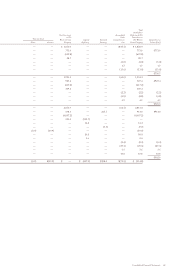

Amounts included in “Retained earnings” reflect the

Company’s earnings subsequent to the spin-off date of

September 29, 2006.

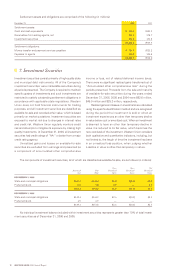

Significant Non-Cash Financing and Investing

Activities Related to Spin-off

In connection with the spin-off, the Company executed

the following transactions which involved no cash:

|| The Company issued $1.0 billion in notes to

First Data in partial consideration for the

contribution by First Data to the Company of

its money transfer and consumer payments

businesses (Note 15). The Company did not

receive any proceeds from the subsequent

private offering of the notes.

|| First Data transferred to the Company its

headquarters in Englewood, Colorado

and certain other fixed assets with a net

book value of $66.5 million.

|| The Company transferred to First Data

certain investments with a net book value

of $20.9 million.

|| The Company reclassified certain tax and

employee-related obligations from intercompany

liabilities totaling $193.8 million.

|| First Data distributed 765.3 million shares

of Western Union’s common stock to holders

of First Data common stock.

Basis of Presentation

The financial statements in this Annual Report for periods

ending on or after the Distribution are presented on a

consolidated basis and include the accounts of the Company

and its majority-owned subsidiaries. The financial statements

for the periods presented prior to the Distribution are

presented on a combined basis and represent those entities

that were ultimately transferred to the Company as part of

the spin-off. The assets and liabilities presented have been

reflected on a historical basis, as prior to the Distribution

such assets and liabilities presented were 100% owned

by First Data. However, the financial statements for the

periods presented prior to the Distribution do not include

all of the actual expenses that would have been incurred

had Western Union been a stand-alone entity during the

periods presented and do not reflect Western Union’s

combined results of operations, financial position and cash

flows had Western Union been a stand-alone company

during the periods presented.

All significant intercompany transactions and accounts

have been eliminated.

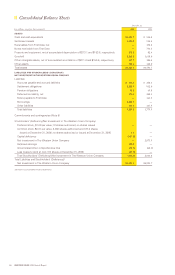

The accompanying Consolidated Balance Sheets are

unclassified consistent with industry practice and due

to the short-term nature of Western Union’s settlement

obligations, contrasted with its ability to invest cash awaiting

settlement in long-term investment securities.

|| 2. Summary of Significant

Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with

accounting principles generally accepted in the United

States of America (“GAAP”) requires management to make

estimates and assumptions that affect the amounts reported

in the financial statements and accompanying notes. Actual

results could differ from these estimates.

Principles of Consolidation

Western Union consolidates financial results when it will

absorb a majority of an entity’s expected losses or residual

returns or when it has the ability to exert control over the

entity. Control is normally established when ownership

interests exceed 50% in an entity. However, when Western

Union does not have the ability to exercise control over a

majority-owned entity as a result of other investors having

contractual rights over the management and operations

of the entity, it accounts for the entity under the equity

method. As of December 31, 2006 and 2005, there were

no greater-than-50%-owned affiliates whose financial

statements were not consolidated. Western Union utilizes

the equity method of accounting when it has an ownership

interest of between 20% and 50% in an entity, provided

it is able to exercise significant influence over the

entity’s operations.