Western Union 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 94

Certain of the Company’s employee stock-based

compensation awards have terms that provide for

vesting to continue after retirement. Prior to the adoption

of SFAS No. 123R, the Company accounted for this type

of arrangement by recognizing pro forma compensation

cost over the stated vesting period for the SFAS No. 123

pro forma disclosures. Upon adoption of SFAS No. 123R,

compensatio n c ost is being recognized over a

shorter period that ends with retirement eligibility.

The impact of applying SFAS No. 123R requirements for

accelerated expense recognition would have impacted pro

forma SFAS No. 123 compensation expense, net of

tax, by a benefit of $1.7 million for the year ended

December 31, 2005 and a charge of $1.0 million for the

year ended December 31, 2004.

As of December 31, 2006, there was $58.0 million of

total unrecognized compensation cost, net of assumed

forfeitures, related to non-vested stock options which is

expected to be recognized over a weighted-average

period of 3.7 years, and there was $27.6 million of total

unrecognized compensation cost, net of assumed

forfeitures, related to non-vested restricted stock awards

and restricted stock units which is expected to be

recognized over a weighted-average period of 2.3 years.

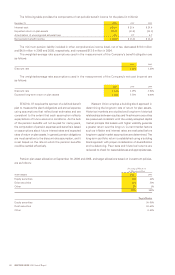

For periods prior to the adoption of SFAS No. 123R, pro forma information regarding the Company’s net income is

required by SFAS No. 123, “Accounting for Stock Based Compensation” (“SFAS No. 123”), as if the Company had

accounted for its employee stock options in First Data stock under the fair value method prescribed by SFAS No. 123.

The Company’s pro forma information for the years ended December 31, 2005 and 2004, which reflects compensation

expense equal to the fair value of the options, restricted stock awards and ESPP rights for Western Union employees

recognized over their vesting periods, is as follows (in millions):

Year Ended December 31, 2005 2004

Reported net income $927.4 $751.6

Restricted stock expense and effect of accelerated vesting

included in reported net income, net of tax 1.9 —

SFAS No. 123 expense, net of tax (37.7) (14.9)

Pro forma net income $891.6 $736.7

Reported earnings per share

—

basic $ 1.21 $ 0.98

Reported earnings per share

—

diluted $ 1.21 $ 0.98

Pro forma earnings per share

—

basic $ 1.17 $ 0.96

Pro forma earnings per share

—

diluted $ 1.17 $ 0.96

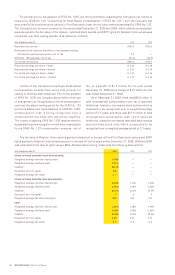

The fair value of Western Union options granted subsequent to the spin-off and First Data stock options and ESPP

rights granted to Western Union employees prior to the spin-off for the years ended December 31, 2006, 2005 and 2004

was estimated at the date of grant using a Black-Scholes option pricing model with the following assumptions:

Year Ended December 31, 2006 2005 2004

STOCK OPTIONS GRANTED (POST-SPIN GRANTS):

Weighted average risk-free interest rate 4.64% — —

Weighted average dividend yield 0.21% — —

Volatility 26.4% — —

Expected term (in years) 6.6 — —

Weighted average fair value $ 7 — —

STOCK OPTIONS GRANTED (PRE-SPIN GRANTS):

Weighted average risk-free interest rate 4.62% 4.14% 3.25%

Weighted average dividend yield 0.58% 0.58% 0.20%

Volatility 23.5% 32.7% 30.5%

Expected term (in years) 5 6 5

Weighted average fair value (pre-spin) $12 $15 $13

ESPP:

Weighted average risk-free interest rate 4.85% 3.12% 1.69%

Weighted average dividend yield 0.56% 0.58% 0.20%

Volatility 23.0% 19.1% 20.5%

Expected term (in years) 0.25 0.25 0.25

Weighted average fair value $ 9 $ 8 $ 8