Western Union 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Management’s Discussion and Analysis of Financial Condition and Results of Operations 57

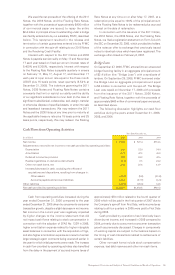

|| Other Commercial Commitments

We had $55.9 million in outstanding letters of credit and

bank guarantees at December 31, 2006, with expiration

dates through 2011, certain of which contain a one-year

renewal option. The letters of credit and bank guarantees

are held primarily in connection with lease arrangements

and agent settlement agreements. We expect to renew

the letters of credit and bank guarantees prior to their

expiration in most circumstances.

|| Critical Accounting Policies

Management’s discussion and analysis of results of

operations and financial condition is based on our financial

statements that have been prepared in accordance with

accounting principles generally accepted in the United

States. The preparation of these financial statements

requires that management make estimates and

assumptions that affect the amounts reported for revenues,

expenses, assets, liabilities and other related disclosures.

Actual results may or may not differ from these estimates.

We believe that the understanding of certain key accounting

policies and estimates are essential in achieving more

insight into our operating results and financial condition.

These key accounting policies include stock-based

compensation, income taxes, derivative financial

instruments and capitalized costs.

Stock-Based Compensation

We adopted SFAS No. 123R effective January 1, 2006.

SFAS No. 123R requires all stock-based payments to

employees to be recognized in the income statement

based on their respective grant date fair values over the

corresponding service periods and also requires an estima-

tion of forfeitures when calculating compensation expense.

We selected the modified-prospective method of adoption

and straight-line amortization of compensation cost over

the requisite service period. We currently utilize the Black-

Scholes Merton option pricing model to measure the fair

value of stock options granted to employees and directors.

While SFAS No. 123R permits entities to continue to use

such a model, the standard also permits the use of a more

complex binomial, or “lattice” model. Based upon the type

and number of stock options expected to be issued in the

future, we have determined that we will continue to use

the Black-Scholes Merton model for option valuation.

Option-pricing models require us to estimate a number of

key valuation inputs including expected volatility, expected

dividend yield, expected term and risk-free interest rate.

The most subjective estimates are the expected volatility

of the underlying stock and the expected term when deter-

mining the fair market value of an option granted. Stock-based

compensation expense, including stock compensation expense

allocated by First Data prior to the spin-off on September 29,

2006 and the impact of adopting SFAS No. 123R, was $30.1

million for the year ended December 31, 2006.

Refer to Note 16 “Stock Compensation Plans” in

the notes to our consolidated financial statements for a

discussion of First Data’s and our stock-based compensation

plans and the adoption of SFAS No. 123R.

Income Taxes

Income taxes, as reported in our consolidated financial

statements, represent the net amount of income

taxes we expect to pay to various taxing jurisdictions in

connection with our operations. We provide for income

taxes based on amounts that we believe we will ultimately

owe. Inherent in the provision for income taxes are

estimates and judgments regarding the tax treatment of

certain items and the realization of certain offsets and

credits. In the event that the ultimate tax treatment of

items or the realizations of offsets or credits differ from

our estimates, we may be required to significantly change

the provision for income taxes recorded in our consolidated

financial statements.

We have established contingency reserves for material,

known tax exposures, including potential tax audit

adjustments with respect to our international operations,

which were restructured in 2003. Our reserves reflect

what we believe to be reasonable assumptions as to the

likely resolution of the issues involved if subject to judicial

review. While we believe that our reserves are adequate

to cover reasonably expected tax risks, there can be no

assurance that, in all instances, an issue raised by a tax

authority will be resolved at a financial cost that does not

exceed our related reserve. Any difference from our position

as recorded in our consolidated financial statements and

the final resolution of a tax issue will be reflected in our

income tax expense in the period during which the issue

is resolved. Such resolution could also affect our effective

tax rate for future periods.

To address certain tax aspects of the 2003 restructuring

of our international operations, discussions were initiated

with the Internal Revenue Service (“IRS”) pursuant to its

Advance Pricing Agreement (“APA”) program. However,

we were notified by the IRS in October 2006 that we will

not be able to conclude an arrangement acceptable to us

through the APA Program. Thus, the tax aspects of the

2003 restructuring will be addressed as part of ongoing

federal income tax audits.

We have benefited from the 2003 restructuring by

having our income from certain foreign-to-foreign money

transfer transactions taxed at relatively low foreign tax

rates rather than the U.S. and state combined statutory

tax rate. The amount of taxes attributable to such rate

differential is included in the “Foreign rate differential”

line in the effective rate reconciliation in Note 10

—

“Income Taxes” to our consolidated financial statements

and cumulatively totaled $210.8 million through

December 31, 2006.

Pursuant to a tax allocation agreement signed in

connection with our spin-off from First Data, we and First

Data each are liable for taxes imposed on our respective

businesses both prior to and after the spin-off. Although

we believe that we have appropriately apportioned such

taxes between First Data and us through 2006, subsequent

adjustments may occur as the tax filings for such years

are made with all applicable tax jurisdictions and such filings

are finalized.