Western Union 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION 2006 Annual Report 34

|| Overview

Western Union is a leader in global money transfer, providing

people with fast, reliable and convenient ways to send

money around the world, pay bills and purchase money

orders. The Western Union

®

brand is globally recognized.

Our services are available through a network of nearly

300,000 agent locations in more than 200 countries

and territories. Each location in our agent network is

capable of providing one or more of our services. As of

December 31, 2006, approximately 75% of our locations

had experienced money transfer activity in the prior twelve

months. Our consumer-to-consumer money transfer service

enables people to send money around the world in minutes.

Our consumer-to-business service provides consumers

with flexible and convenient options for making one-time

or recurring payments.

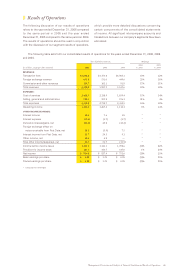

In 2006, we generated $4.5 billion in total consolidated

revenues and $914.0 million in consolidated net income.

We handled 147 million consumer-to-consumer money

transfers in 2006, an increase of 24% over 2005. Our

249 million consumer-to-business transactions in 2006

represented a 16% increase over 2005.

We believe that brand strength, size and reach of our

global network, and convenience and reliability for our

consumers have been key to the growth of our business.

As we continue to meet the needs of our consumers for

fast, reliable and convenient money transfer services, we

are also working to enhance our existing services and

provide our consumers with access to an expanding portfolio

of payment and other financial services.

|| History and Development

Western Union has roots back to 1851. It first traded on

the New York Stock Exchange in 1865. In 1884, Western

Union was one of the original 11 companies included on

the first Dow Jones average listing. We have a long history

of providing innovative services, including creating the

universal stock ticker and launching the first United States

commercial communications satellite service. We introduced

our consumer-to-consumer money transfer service in 1871.

We began offering consumer-to-business payment services

in 1989 when we introduced Western Union Quick Collect

®

or “Quick Collect,” providing consumers in the United

States with the ability to conveniently pay bills in cash

through our agent network.

Over the past decade, we have become a leader in

the development of a formal global remittance market.

Today, we offer money transfer and bill payment services

under the Western Union,

®

Orlandi Valuta,

®

Vigo

SM

and Pago

FácilSM brands in over 200 countries and territories.

The Western Union Company was incorporated in

Delaware as a wholly owned subsidiary of First Data on

February 17, 2006 in anticipation of the planned spin-off

described below.

|| The Western Union Business

Our revenue is principally generated by money transfer

and payment transactions. We derive our revenue primarily

from two sources. Most of our revenue comes from fees

that consumers pay when they send money. In certain

consumer money transfer transactions involving different

send and receive currencies, we generate revenue based

on the difference between the exchange rate set by us to

the consumer and the rate at which we or our agents are

able to acquire currency.

In our consumer-to-consumer segment we provide

our third-party agents with our multi-currency, real-time

money transfer processing systems used to originate and

pay money transfers. Our agents provide the physical

infrastructure and staff required to complete the transfers.

We generally pay our agents a commission based on a

percentage of revenue. The commission is shared between

the agent that initiated the transaction, the “send agent,”

and the agent that paid out the transaction, the “receive

agent.” For most agents, the costs of providing the physical

infrastructure and staff are typically covered by the agent’s

primary business (e.g., postal services, banking, check

cashing, travel and retail businesses), making the economics

of being a Western Union agent attractive to our agents.

Western Union’s global reach and loyal consumer base

allow us to attract agents we believe to be of high quality.

In our consumer-to-business segment we offer

consumers options to make payments electronically over

the telephone or the Internet, and to make cash payments

in person at an agent location. We process electronic

payments using the consumer’s credit card, debit card or

bank account. We process cash payments much like we

process consumer-to-consumer transactions.

|| Our Segments

We manage our business around the consumers we serve

and the type of services we offer. Each segment addresses

a different combination of consumer needs, distribution

networks and services.

|| CONSUMER-TO-CONSUMER

—

provides money transfer

services between consumers, primarily through a global

network of third-party agents using our multi-currency,

real-time money transfer processing systems.

|| CONSUMER-TO-BUSINESS

—

focuses on payments from

consumers to billers through our networks of third-

party agents and various electronic channels. While

we continue to pursue international expansion of our

offerings in selected markets, as demonstrated by our

December 2006 acquisition of Servicio Electrónico de

Pago S.A. and related entities (“SEPSA”), substantially

all of the segment’s 2006 revenue was generated in the

United States.