Western Union 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements 87

The Company previously restated its financial

statements for certain derivatives originally intended to

qualify as cash flow hedges in accordance with SFAS

No. 133. On September 29, 2006, the Company either

settled its outstanding derivatives that were determined

to not qualify for hedge accounting or offset such

derivatives with new derivatives that were not designated

as hedges in accordance with SFAS No. 133. As such, the

effect of the changes in the fair value of these hedges

prior to September 29, 2006 is included in “Derivative

(losses)/gains, net.” On September 29, 2006 and during

the fourth quarter of 2006, the Company entered into new

derivative contracts in accordance with its revised foreign

currency derivatives and hedging processes, which were

designated and qualify as cash flow hedges under SFAS

No. 133.

The Company does not believe its derivative financial

instruments expose it to more than a nominal amount

of credit risk as the counterparties are established,

well-capitalized financial institutions with credit ratings of

“A” or better from major rating agencies. The credit risk

inherent in these agreements represents the possibility

that a loss may occur from the nonperformance of a

counterparty to the agreements. The Company performs

a review of the credit risk of these counterparties at

the inception of the hedge, on a quarterly basis and

as circumstances warrant. The Company also monitors

the concentration of its contracts with any individual

counterparty. The Company anticipates that the

counterparties will be able to fully satisfy their obligations

under the agreements. The Company’s exposures are in

liquid currencies, so there is minimal risk that appropriate

derivatives to maintain the hedging program would not be

available in the future.

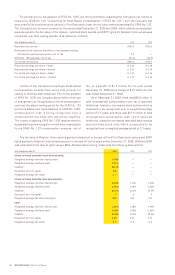

The details of each designated hedging relationship

are formally documented at the inception of the

arrangement, including the risk management objective,

hedging strategy, hedged item, specific risks being hedged,

the derivative instrument, how effectiveness is being

assessed and how ineffectiveness, if any, will be measured.

The derivative must be highly effective in offsetting the

changes in cash flows, and effectiveness is continually

evaluated on a retrospective and prospective basis. The

Company assesses the effectiveness of its foreign currency

forward contracts, used to mitigate some of the risks

related to forecasted revenues, based on changes in the

spot rate of the affected currencies during the period

of designation. Accordingly, all changes in the fair value

of the hedges not considered effective are recognized

immediately in “Derivative (losses)/gains, net” within the

Company’s Consolidated Statements of Income. Changes

in the fair value due to the interest rate differential between

the two currencies, and all changes in the fair value during

periods in which the instrument was not designated as a

hedge, were excluded from the measure of effectiveness

and resulted in a $1.5 million gain during the year ended

December 31, 2006.

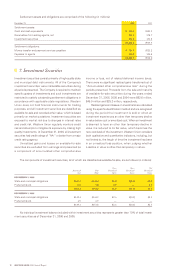

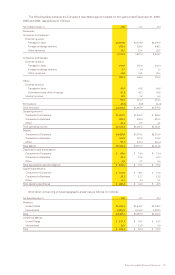

The aggregate United States dollar equivalent notional amount of foreign currency forward contracts held by the

Company with external third parties as of the balance sheet dates are as follows (in millions):

December 31, 2006 2005

Contracts not designated as hedges:

Euro $249.5 $497.8

British pound 43.5 82.0

Other 51.1 78.1

Contracts designated as hedges:

Euro 333.9 —

British pound 73.2 —

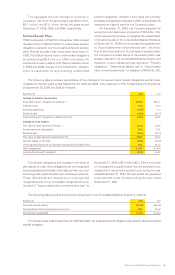

As of December 31, 2006 and 2005, the carrying value

and fair value of the Company’s foreign currency forward

contracts with external third parties was a $12.2 million

net liability and an $18.3 million net asset, respectively, as

disclosed in Note 9.

The aggregate notional amount of foreign currency

swap arrangements held by the Company with First Data

affiliates totaled 238.1 million euros at December 31, 2005.

The fair market value of these swaps ($7.2 million asset

as of December 31, 2005) was settled in cash along with

the related notes receivable in connection with the spin-off

on September 29, 2006 (Note 1).

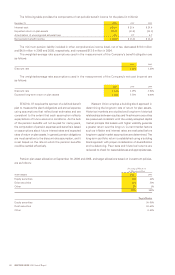

In October 2006, the Company executed forward

starting interest rate swaps with a combined notional

amount of $875 million to fix the interest rate in connection

with an anticipated issuance of fixed rate debt securities

expected to be issued between October 2006 and May

2007. The Company designated these derivatives as cash

flow hedges of the variability in the cash outflows of interest

payments on the first $875 million of the forecasted debt

issuance due to changes in the benchmark interest rate.

The swaps were expected to be highly effective in hedging

the interest payments associated with the forecasted debt

issuance as the terms of the hedges, including the life and

notional amount, mirrored the probable issuance dates of

the forecasted debt issuances, and statistical analyses of

historical relationships indicated a high correlation between

spot and forward swap rates for all possible issuance dates

within the expected range of issuance dates.