Western Union 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Management’s Discussion and Analysis of Financial Condition and Results of Operations 45

The year ended December 31, 2005 included lower

employee incentive compensation expense compared to

2004 primarily as a result of certain internal performance

targets for First Data not being achieved in 2005 whereas

all targeted discretionary incentive compensation was paid

in 2004.

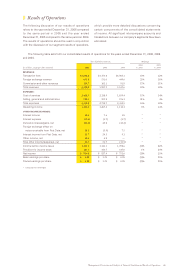

Selling, General and Administrative

Selling, general and administrative expenses increased for

the year ended December 31, 2006 due primarily to higher

costs incurred in 2006 related to Vigo, increased costs

associated with being a stand-alone public company

discussed below, higher stock compensation expense

from the adoption of SFAS No. 123R, and higher employee

incentive compensation expenses in 2006 compared

to 2005.

In line with our strategic objective of building the

Western Union brand, marketing related expenditures

included in operating expenses increased during the year

ended December 31, 2006 over the comparable period in

2005 and were approximately 7% of consolidated revenue,

a trend that has occurred over the last three years and we

expect will continue in the future. Marketing expense

includes advertising, events, loyalty programs and employees

dedicated to marketing activities.

Incremental independent public company expenses

of $25 million in 2006 relate to staffing additions and related

costs to replace First Data support, corporate governance,

information technology, corporate branding and global

affairs, benefits and payroll administration, procurement,

workforce reorganization, stock compensation, and other

expenses related to being a stand-alone public company

as well as recruiting and relocation expenses associated

with hiring key management positions new to our company,

other employee compensation expenses and temporary

labor used to develop ongoing processes. These expenses

are those in excess of amounts allocated to us by First

Data prior to September 29, 2006 or beyond amounts we

presume First Data would have allocated subsequently

thereto. We expect most of these expenses will continue

to be incurred in future periods.

SG&A expenses increased for the years ended

December 31, 2005 and 2004 due to an increase in

marketing related expenses over that in the prior years in

line with increases in our revenues. The year ended

December 31, 2005 also included lower employee incentive

compensation expense compared to 2004 primarily as

a result of certain internal performance targets for First

Data not being achieved in 2005 whereas all targeted

discretionary incentive compensation was paid in 2004.

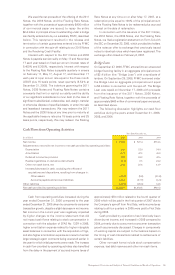

Interest Income

Interest income increased during the year ended

December 31, 2006 compared to 2005 due to higher

international cash balances resulting from the net cash

received in connection with the settlement of intercompany

notes with First Data (net of certain other payments made

to First Data) on the spin-off date, and from cash generated

through our international operations. Also contributing to

higher interest income in 2006 was interest income recorded

in connection with a loan for $140.0 million made to one

of our agents in the first quarter of 2006. Interest income

during the year ended December 31, 2005 also benefited

from higher international cash balances generated through

our international operations compared to 2004.

Interest Expense

Interest expense increased to $53.4 million for the year

ended December 31, 2006 compared to $1.7 million

during 2005, due to interest expense on our outstanding

borrowings that arose in connection with the spin-off

on September 29, 2006. Interest expense will increase

significantly in 2007 since the related borrowings will be

outstanding during the full year of 2007 compared to three

months during 2006.

Derivative (Losses)/Gains, Net

Our foreign currency forward contracts that did not qualify

as hedges under applicable derivative accounting rules

were held primarily in the euro and British pound and have

a maturity of one year or less. Prior to September 29, 2006,

we did not have any forward contracts that qualified

as hedges, and therefore the gains and losses on these

contracts were reflected in income prior to that date. Gains

and losses resulting from changes in the valuation of these

forward contracts were recognized based on variations

between foreign currency market exchange rates and the

forward contract rates, primarily the euro, which resulted

in foreign currency losses in 2006 of $21.2 million, gains of

$45.8 million in 2005, and losses of $30.2 million in 2004.

On September 29, 2006, we re-established our foreign

currency forward positions to qualify for cash flow hedge

accounting. As a result, on a go-forward basis, we anticipate

the amounts reflected in this income statement caption

will be minimal, and will relate primarily to the portion of

the change in fair value that is considered ineffective or is

excluded from the measure of effectiveness related to

contracts designated as accounting hedges. For example,

in the fourth quarter of 2006, after we re-established our

foreign currency forward positions to qualify for hedge

accounting, our foreign exchange gain recognized was

$0.6 million compared to a gain of $7.2 million during the

fourth quarter of 2005 when our foreign currency forward

contracts did not qualify for hedge accounting treatment.