Western Union 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 84

SFAS No. 87 requires the sponsor of a defined benefit

plan to measure the plan’s obligations and annual expense

using assumptions that reflect best estimates and are

consistent to the extent that each assumption reflects

expectations of future economic conditions. As the bulk

of the pension benefits will not be paid for many years,

the computation of pension expenses and benefits is based

on assumptions about future interest rates and expected

rates of return on plan assets. In general, pension obligations

are most sensitive to the discount rate assumption, and it

is set based on the rate at which the pension benefits

could be settled effectively.

Western Union employs a building block approach in

determining the long-term rate of return for plan assets.

Historical markets are studied and long-term historical

relationships between equities and fixed-income securities

are preserved consistent with the widely accepted capital

market principle that assets with higher volatility generate

a greater return over the long run. Current market factors

such as inflation and interest rates are evaluated before

long-term capital market assumptions are determined. The

long-term portfolio return is established using a building

block approach with proper consideration of diversification

and re-balancing. Peer data and historical returns are

reviewed to check for reasonableness and appropriateness.

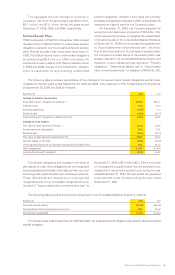

The following table provides the components of net periodic benefit income for the plans (in millions):

December 31, 2006 2005 2004

Interest cost $ 24.8 $ 25.6 $ 29.0

Expected return on plan assets (29.9) (33.8) (35.3)

Amortization of unrecognized actuarial loss 4.2 2.7 0.7

Net periodic benefit income $ (0.9) $ (5.5) $ (5.6)

The minimum pension liability included in other comprehensive income (loss), net of tax, decreased $10.8 million

and $4.9 million in 2006 and 2005, respectively, and increased $13.6 million in 2004.

The weighted-average rate assumptions used in the measurement of the Company’s benefit obligation are

as follows:

2006 2005

Discount rate 5.61% 5.25%

The weighted-average rate assumptions used in the measurement of the Company’s net cost (income) are

as follows:

2006 2005 2004

Discount rate 5.24% 5.19% 5.90%

Expected long-term return on plan assets 7.50% 7.75% 8.00%

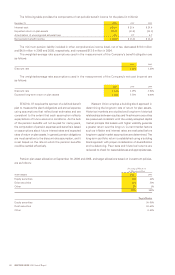

Pension plan asset allocation at September 30, 2006 and 2005, and target allocations based on investment policies,

are as follows:

Percentage of Plan Assets

at Measurement Date

Asset Category 2006 2005

Equity securities 40% 44%

Debt securities 58% 55%

Other 2% 1%

100% 100%

Target Allocation

Equity securities 30-50%

Debt securities 50-60%

Other 0-10%