Western Union 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 88

In November 2006, the Company terminated these

swaps in conjunction with the issuance of the 2011 and

2036 Notes as described in Note 15, by paying cash of

approximately $18.6 million to the counterparties. The

difference in the actual issuance date and the probable

issuance date as stated in our hedge designation

documentation resulted in ineffectiveness of $0.6 million,

which was immediately recognized in “Derivative (losses)/

gains, net” in the Consolidated Statements of Income. No

amounts were excluded from the measure of effectiveness.

The remaining $18.0 million loss on the hedges was included

in “Accumulated other comprehensive loss” and will

be reclassified to “Interest expense” over the life of the

related notes.

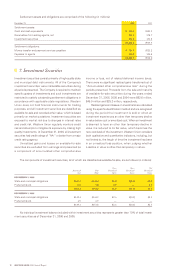

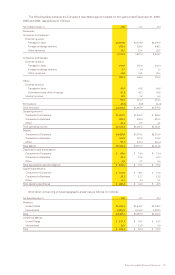

The following table summarizes activity in “Accumulated other comprehensive loss” related to all derivatives

designated as cash flow hedges (in millions):

2006 2005 2004

Balance included in “Accumulated other comprehensive loss” at January 1, $ — $— $—

Reclassification into earnings from “Accumulated other comprehensive loss”:

Revenue (1.8) — —

Interest expense 0.2 — —

Total reclassifications (1.6) — —

Changes in fair value of derivatives, net of tax (27.7) — —

Balance included in “Accumulated other comprehensive loss” at December 31, $(29.3) $— $—

As of December 31, 2006, the maximum length

of time over which the Company is hedging its exposure

to the variability in future cash flows associated with

foreign currency risk related to future revenues is

12 months. Therefore, $11.5 million of “Accumulated

other comprehensive loss” related to the foreign currency

forward contracts is expected to be reclassified into revenue

within the next 12 months. Approximately $1.7 million

of losses on the forecasted debt issuance hedges

are expected to be recognized in interest expense during

the next 12 months. No amounts have been reclassified

into earnings as a result of the underlying transaction no

longer being considered probable of occurring within the

specified time period.

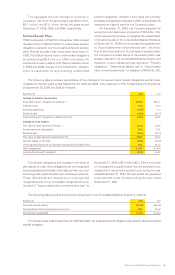

|| 15. Borrowings

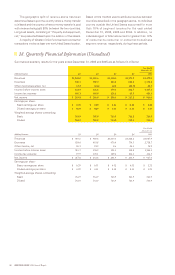

The Company’s outstanding borrowings at December 31, 2006 consist of the following (in millions):

December 31, 2006

Carrying Value Fair Value

Short-term:

Commercial paper $ 324.6 $ 324.6

Note payable due January 2007 3.0 3.0

Long-term:

Floating rate notes, due 2008 500.0 499.8

5.400% notes, net of discount, due 2011 999.0 986.3

5.930% notes, net of discount, due 2016 999.7 992.2

6.200% notes, net of discount, due 2036 497.2 471.4

Total borrowings $3,323.5 $3,277.3

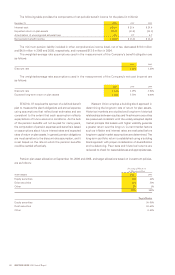

Exclusive of discounts, maturities of borrowings as

of December 31, 2006 are $327.6 million in 2007,

$500.0 million in 2008, $1.0 billion in 2011 and $1.5 billion

thereafter. There are no contractual maturities on borrowings

during 2009 and 2010.

No borrowings existed at December 31, 2005. The

Company’s obligations under all of its financing facilities,

as described below, rank equally.

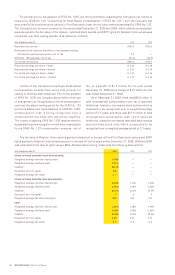

Commercial Paper Program

On November 3, 2006, the Company established a

commercial paper program pursuant to which the Company

may issue unsecured commercial paper notes (the

“Commercial Paper Notes”) in an amount not to exceed

$1.5 billion outstanding at any time prior to the commercial

paper program expiration in 2011. The Commercial Paper

Notes may have maturities of up to 397 days from date of

issuance. Interest rates for borrowings are based on market

rates at the time of issuance. The Company’s commercial

paper borrowings at De cember 31, 2006 were

$324.6 million, had a weighted average interest rate

of approximately 5.4% and a weighted-average initial term

of 17 days. At December 31, 2006, $1,175.4 million was

available to borrow under the commercial paper program.