Western Union 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 78

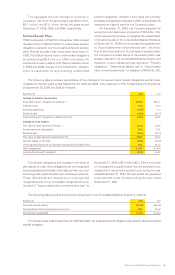

|| 7. Investment Securities

Investment securities consist primarily of high-quality state

and municipal debt instruments. All of the Company’s

investment securities were marketable securities during

all periods presented. The Company is required to maintain

specific grades of investments and such investments are

restricted to satisfy outstanding settlement obligations in

accordance with applicable state regulations. Western

Union does not hold financial instruments for trading

purposes, and all investment securities are classified as

available-for-sale and recorded at fair value, which is based

primarily on market quotations. Investment securities are

exposed to market risk due to changes in interest rates

and credit risk. Western Union regularly monitors credit

risk and attempts to mitigate its exposure by making high

quality investments. At December 31, 2006, all investment

securities had credit ratings of “AA-” or better from a major

credit rating agency.

Unrealized gains and losses on available-for-sale

securities are excluded from earnings and presented as

a component of accumulated other comprehensive

income or loss, net of related deferred income taxes.

There were no significant realized gains transferred out of

“Accumulated other comprehensive loss” during the

periods presented. Proceeds from the sale and maturity

of available-for-sale securities during the years ended

December 31, 2006, 2005 and 2004 were $62.6 million,

$49.0 million and $25.3 million, respectively.

Realized gains and losses on investments are calculated

using the specific-identification method and are recognized

during the period the investment is sold or when an

investment experiences an other than temporary decline

in value below cost or amortized cost. When an investment

is deemed to have an other than temporary decline in

value it is reduced to its fair value, which becomes the

new cost basis of the investment. Western Union considers

both qualitative and quantitative indicators, including, but

not limited to, the length of time the investment has been

in an unrealized loss position, when judging whether

a decline in value is other-than-temporary in nature.

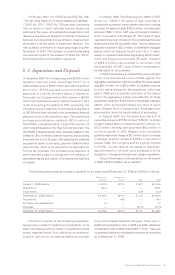

Settlement assets and obligations are comprised of the following (in millions):

December 31, 2006 2005

Settlement assets:

Cash and cash equivalents $ 348.8 $183.9

Receivables from selling agents, net 781.2 578.7

Investment securities 154.2 151.8

$1,284.2 $914.4

Settlement obligations:

Money transfer and payment services payables $ 714.5 $521.2

Payables to agents 568.0 390.8

$1,282.5 $912.0

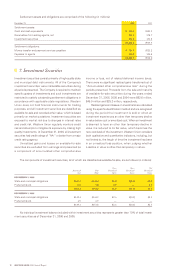

The components of investment securities, all of which are classified as available-for-sale, are as follows (in millions):

Gross Gross Net

Amortized Fair Unrealized Unrealized Unrealized

Cost Value Gains Losses Gains

DECEMBER 31, 2006

State and municipal obligations $145.5 $146.4 $1.0 $(0.1) $0.9

Preferred stock 6.9 7.8 0.9 — 0.9

$152.4 $154.2 $1.9 $(0.1) $1.8

DECEMBER 31, 2005

State and municipal obligations $142.4 $144.9 $2.6 $(0.1) $2.5

Preferred stock 6.9 6.9 — — —

$149.3 $151.8 $2.6 $(0.1) $2.5

No individual investment balance included within investment securities represents greater than 10% of total invest-

ment securities as of December 31, 2006 and 2005.