Western Union 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION 2006 Annual Report 74

Stock-Based Compensation

Prior to the spin-off, employees of Western Union

participated in First Data’s stock-based compensation plans.

The Company currently has a stock-based compensation

plan that grants Western Union stock options, restricted

stock awards and restricted stock units to employees and

other key individuals who perform services for the Company.

In addition, the Company has a stock-based compensation

plan that provides for grants of Western Union stock options

and stock unit awards to non-employee directors of

the Company.

Effective January 1, 2006, the Company adopted

Statement of Financial Accounting Standards (“SFAS”)

No. 123R, “Share-Based Payment” (“SFAS No. 123R”),

using the modified prospective method. SFAS No. 123R

requires all stock-based compensation to employees be

measured at fair value and expensed over the requisite

service period and also requires an estimate of forfeitures

when calculating compensation expense. The Company

recognizes compensation expense on awards on a straight-

line basis over the requisite service period for the entire

award. In accordance with the Company’s chosen method

of adoption, results for prior periods have not been adjusted.

Prior to the adoption of SFAS No. 123R, the Company

followed Accounting Principles Board (“APB”) Opinion

No. 25 which accounts for share-based payments to

employees using the intrinsic value method and, as such,

generally recognized no compensation expense for

employee stock options. Refer to Note 16 for additional

discussion regarding details of the Company’s stock-based

compensation plans and the adoption of SFAS No. 123R.

Reclassifications

Certain prior years amounts have been reclassified to

conform to the current year presentation. The Company

made certain reclassifications between settlement assets

and settlement obligations, which have no impact on

the Company’s consolidated financial position, results of

operations or cash provided from operations as previously

reported. In addition, the Company reclassified interest

income and interest expense related to third parties from

“Other income, net” to “Interest income” and “Interest

expense” to disclose them separately on the face of the

Consolidated Statements of Income. This reclassification

also had no impact on the consolidated financial position,

results of operations or cash provided from operations as

previously reported.

New Accounting Pronouncements

The Financial Accounting Standards Board (“FASB”) has

issued interpretation No. 48, “Accounting for Uncertainty

in Income Taxes—An Interpretation of FASB Statement

No. 109” (“FIN 48”), regarding accounting for, and

disclosure of, uncertain income tax positions. FIN 48 clarifies

the accounting for uncertainty in income taxes recognized

in an enterprise’s financial statements in accordance with

FASB Statement No. 109, “Accounting for Income Taxes.”

FIN 48 prescribes a recognition threshold and measurement

attribute for the financial statement recognition and

measurement of a tax position taken or expected to

be taken in a tax return. FIN 48 also provides guidance

on derecognition, classification, interest and penalties,

accounting for interim periods, disclosure and transition.

FIN 48 is effective for fiscal years beginning after

December 15, 2006. FIN 48 requires that the cumulative

effect of adopting its provisions be reflected as an

adjustment to opening retained earnings for the year of

adoption. We are currently evaluating the impact of adopting

FIN 48, however, we do not expect the effect of adoption

to be significant.

In September 2006, the FASB issued SFAS No. 157,

“Fair Value Measurements” (“SFAS No. 157”), which

defines fair value, establishes a framework for measuring

fair value under GAAP and expands disclosures about fair

value measurements. SFAS No. 157 applies to other

accounting pronouncements that require or permit fair

value measurements. The new guidance is effective for

financial statements issued for fiscal years beginning

after November 15, 2007, and for interim periods within

those fiscal years. The Company is currently evaluating

the potential impact of the adoption of SFAS No. 157 on

its consolidated financial position, results of operations

and cash flows.

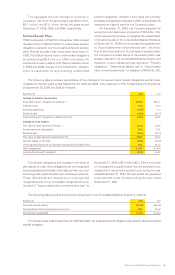

On September 29, 2006, the FASB issued SFAS

No. 158, “Employers Accounting for Defined Benefit

Pension and Other Postretirement Plans—An Amendment

of SFAS No. 87, 88, 106 and 132(R)” (“SFAS No. 158”).

The statement requires employers to recognize the

overfunded and underfunded portion of a defined

benefit plan as an asset or liability, respectively, and any

unrecognized gains and losses or prior service costs as a

component of accumulated other comprehensive income.

SFAS No. 158 also requires a plan’s funded status to

be measured at the employer’s fiscal year-end. The

requirement to recognize the funded status of a defined

benefit plan and the disclosure requirements of

SFAS No. 158 are effective for the Company as of

December 31, 2006. The requirement to measure plan

assets and benefit obligations as of the date of the employer’s

fiscal year end is effective for the Company in 2008. The

adoption of the requirements of SFAS No. 158 that became

effective on December 31, 2006 did not have a material

impact to the financial position, results of operations or

cash flows of the Company due to the frozen status of the

Company’s defined benefit pension plans. However, the

Company will need to change its measurement date from

September 30 to December 31 no later than 2008.