Western Union 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

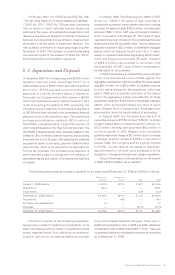

Notes to Consolidated Financial Statements 85

The maturities of debt securities at September 30, 2006

range from less than one year to 60 years with a weighted-

average maturity of 15 years.

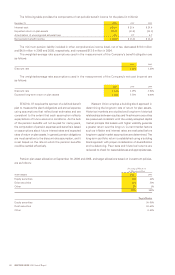

Western Union employs a total return investment

approach whereby a mix of equities and fixed income

investments are used in an effort to maximize the long-term

return of plan assets for a prudent level of risk. Risk

tolerance is established through careful consideration of

plan liabilities and plan funded status. The investment

portfolio contains a diversified blend of equity and fixed-

income investments. Furthermore, equity investments are

diversified across U.S. and non-U.S. stocks, as well as

securities deemed to be growth, value, and small and large

capitalizations. Other assets, primarily private equity, are

used judiciously in an effort to enhance long-term returns

while improving portfolio diversification. Investment risk

is measured and monitored on an ongoing basis through

quarterly investment portfolio reviews, annual liability

measurements, and periodic asset and liability studies.

The estimated future benefit payments are expected

to be $45.2 million in 2007, $44.1 million in 2008,

$42.9 million in 2009, $41.8 million in 2010, $40.6 million

in 2011 and $183.0 million in 2012 through 2016.

Western Union administers a post-retirement health

care plan to union employees that was in effect when First

Data acquired FFMC. Generally, retired employees bear

the entire cost of the premiums. Western Union also offers

a short-term disability plan for union employees. The

Company’s obligations pursuant to these plans are

immaterial.

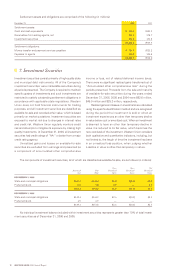

|| 12. Operating Lease

Commitments

Western Union leases certain real properties for use as

customer service centers and administrative and sales

offices. Western Union also leases data communications

terminals, computers and office equipment. Certain of

these leases contain renewal options and escalation

provisions. These leases include certain sublease

agreements with First Data, as discussed in Note 4. Total

rent expense under operating leases was $29.2 million,

$28.6 million, and $26.3 million during the years ended

December 31, 2006, 2005 and 2004, respectively.

As of December 31, 2006, the minimum aggregate

rental commitments under all noncancelable operating

leases, net of sublease income commitments aggregating

$9.1 million through 2011, are as follows (in millions):

Year Ending December 31,

2007 $20.5

2008 16.8

2009 9.2

2010 7.2

2011 5.9

Thereafter 19.7

Total future minimum lease payments $79.3

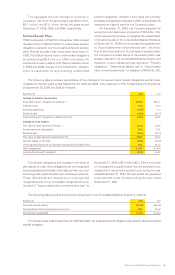

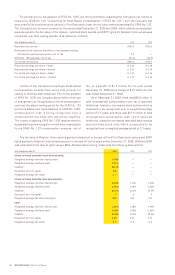

Certain members of the Company’s Board of Directors and management are affiliated with companies whose

securities are held in Western Union’s pension trust, which is managed by independent asset managers. Therefore,

these affiliated companies are considered related parties. The following table details plan assets invested in these related

party securities as of September 30, 2006 and 2005:

2006

Fair Market

Shares Value % of Total

Plan Common Stock Holdings (in thousands) (in millions) Plan Assets

Altria Group, Inc. common stock 11.4 $0.9 0.21%

First Data Corporation common stock 14.9 $0.3 0.08%

The Western Union Company common stock 14.9 $0.3 0.07%

Bank of New York Company Inc. common stock 23.6 $0.8 0.20%

Fair Market

Principal Value % of Total

Plan Corporate Bond Holdings (in millions) (in millions) Plan Assets

Allstate Corporation corporate bond $0.5 $0.6 0.14%

Kraft Foods corporate bond $0.6 $0.7 0.16%

New York Life Insurance Company corporate bond $0.8 $0.8 0.19%

2005

Fair Market

Shares Value % of Total

Plan Asset Holdings (in thousands) (in millions) Plan Assets

First Data Corporation common stock 18.1 $0.7 0.16%

Bank of New York Company Inc. common stock 23.8 $0.7 0.16%

Hewitt Associates, Inc. common stock 5.5 $0.1 0.02%