Western Union 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION 2006 Annual Report 36

WALK-IN MONEY TR ANSFE R SERVICE. The majority of

Western Union, Orlandi Valuta and Vigo remittances

constitute transactions in which cash is collected by the

agent and payment (usually cash) is available for pick-up

at another agent location in the designated receive country,

usually within minutes.

Western Union continues to develop new services

that enhance consumer convenience and choice and are

customized to meet the needs of consumers in the regions

where these services are offered. In the United States,

consumers can use a debit card to send transactions from

many agent locations. In some United States outbound

corridors and in select international corridors, Western

Union provides Direct to Bank service, enabling a consumer

to send a transaction from an agent location directly to a

bank account in another country. In certain countries,

Western Union offers payout options through a debit or

stored-value card, or through a money order. In a number

of countries in Latin America and the Caribbean, Western

Union agents offer a bank deposit service, in which the

paying agent provides the receiver the option to direct

funds to a bank account or to a stored-value card. Vigo also

offers Direct to Bank and home delivery service in certain

receive countries.

Our “Next Day Delivery” option is a money transfer

that is available for payment 24 hours after it is sent. This

option is available in certain markets for domestic service

within the United States, and in select United States

outbound and international corridors, including Mexico.

The Next Day Delivery service gives our consumers a

lower-priced option for money transfers that do not need

to be received within minutes. The service still offers the

convenience, reliability and ease-of-use that the Western

Union brand represents.

Our “Money Transfer by Phone” service is available

in select Western Union agent locations in the United

States. In a Money Transfer by Phone transaction, the

consumer is able to use a telephone in the agent location

to speak to a Western Union representative in one

of several languages. Typically the sender provides the

information necessary to complete the transaction to

the Western Union operator on the phone and is given a

transaction number, which the sender takes to the agent’s

in-store representative to send the funds.

ONLINE MONEY TRANSFER SERVICE.

Our Internet website,

westernunion.com, allows consumers to send funds

on-line, using a credit or debit card, for pay-out at Western

Union-branded agent locations around the world. Transaction

capability at westernunion.com was launched in the United

States in 2000 and in Canada in 2002. Since 2004, Western

Union has expanded the service to additional countries

outside the United States.

TELEPHONE MONEY TRANSFER SERVICE.

Our Telephone

Money Transfer service allows Western Union consumers

to send funds by telephone without visiting an agent location.

Consumers call a toll-free number in the United States or

the United Kingdom and use a debit card or credit card to

initiate a transaction. The money transfer is then available

for pay-out at an agent location.

Distribution and Marketing Channels

We offer our consumer-to-consumer service through our

global network of third-party agents and the other initiation

and payment methods discussed above. Western Union

provides central operating functions such as transaction

processing, marketing support and customer relationship

management to our agents.

Some of our Western Union agents outside the United

States manage subagents. Although these subagents

are under contract with our primary agents (and not

with Western Union directly), the subagent locations have

access to the same technology and services that our agent

locations do.

Our international agents are able to customize services

as appropriate for their geographic markets. In some

markets individual agents are independently offering specific

services such as stored-value payout options and direct

to bank service. Our marketing relies on feedback from

our agents and consumers, and our agents also market

our services.

In February 2005, Western Union International Bank

began operations. We chartered the bank in order to adapt

to the challenges presented by the growing trend among

the member states of the European Union to regulate the

money transfer business. Western Union International

Bank holds a full credit institution license, allowing it to

offer a range of financial services throughout the 27 member

states of the European Union and the three additional

states of the European Economic Area. Today, the bank

offers retail service in over 20 locations in three countries

and online money transfer services in seven countries.

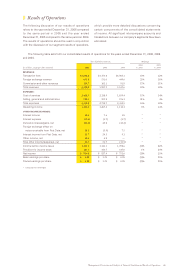

Industry Trends

We participate in a large and growing market for money

transfer. Growth in the money transfer business tends to

correlate to immigration and related employment rates

worldwide. Therefore, an indicator for future growth is the

size of the international migrant population, which to a

certain extent follows economic opportunity worldwide.

In 2006, the United Nations reported that there were

191 million people living outside their country of origin in

2005. We anticipate that demand for money transfer

services will continue to grow as individuals continue to

migrate to countries outside of their country of origin.

According to a 2005 United Nations report, during 2005 to

2050, the net number of international migrants moving to

more developed regions of the world is projected to increase

by 98 million or an average of 2.2 million annually.

Aite Group, LLC or “Aite,” an independent research

and advisory firm, estimated in a January 2005 report that

the total value of remittances sent by workers to developed

and emerging regions would be $269 billion in 2006 and

that this amount would grow to $289 billion in 2007. These

figures were estimated primarily by using balance of

payments data reported by the International Monetary

Fund, the Inter-American Development Bank, central banks

and money transmitters. They do not capture all of the

money transfers sent through informal channels and do

not measure the size of the intra-country market. The World

Bank estimates that unrecorded remittances are at least

half as large as recorded remittances.