Western Union 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

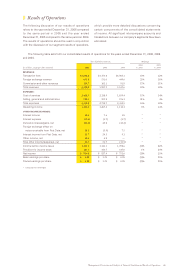

Management’s Discussion and Analysis of Financial Condition and Results of Operations 49

Fluctuations in the exchange ratio between the euro

and the United States dollar have resulted in the following

benefit or reduction to consumer-to-consumer revenue

over the previous year, net of foreign currency hedges,

that would not have occurred had there been a constant

exchange ratio (in millions):

Year Ended December 31, Benefit /(Reduction)

2006 $11.5

2005 $ (1.4)

2004 $73.4

On a euro-adjusted basis, international revenue grew

16% for the year ended December 31, 2006, compared

to 16% in the comparable period in 2005, with Vigo

contributing 2% to the growth rates for the year ended

December 31, 2006.

The difference between international transaction

growth and revenue growth was relatively consistent during

the year ended December 31, 2006 compared to the

corresponding period in 2005. The slight increase in the

difference between international transaction growth and

revenue growth for the year ended December 31, 2006

was driven by Vigo transactions, which have lower revenue

per transaction compared to the Western Union branded

business. The impact from Vigo transactions was partially

offset by the stronger euro compared to 2005, which

benefited revenue growth, but not transaction growth.

Growth in Mexico money transfer transactions for

the year ended December 31, 2006 compared to the same

period in 2005 was driven by the acquisition of Vigo

and growth in Western Union branded transactions,

partially offset by a decline in Orlandi Valuta branded

transactions. Revenues from Western Union branded

U.S. to Mexico transactions increased 6% for the year

ended December 31, 2006, compared to 26% for the same

period in 2005. The decline in revenue growth rates was

primarily due to the uncertainty created by the immigration

debate in the United States as described above.

Domestic transaction growth rates in the year ended

December 31, 2006 over the same period in 2005 declined

compared to increases observed for the year 2005 due in

part to the uncertainty created by the immigration debate

described above, and broader market softness experienced

within the United States domestic business in 2006.

Foreign exchange revenue increased for the year

ended December 31, 2006 due to the acquisition of Vigo

and an increase in the higher growth international business

resulting in increased cross-currency transactions.

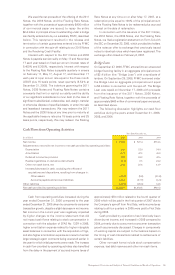

Contributing to the increase in total consumer-to-

consumer money transfer revenue and transaction growth

in all periods presented was the growth in transactions

at existing agent locations, the number of agent locations

and marketing campaigns promoting Western Union

services. The majority of transaction growth is derived

from more mature agent locations as new agent locations

typically contribute only marginally to revenue growth in

the first few years of their operation. Increased productivity,

measured by transactions per location, often is experienced

as locations mature. We believe that new agent locations

will help drive growth by increasing the number of locations

available to send and receive money. We generally refer

to locations with more than 50% of transactions being

initiated versus paid out as “send locations” and to the

balance of locations as “receive locations.” Send locations

are the engine that drives consumer-to-consumer revenue.

They contribute more transactions per location than receive

locations. However, a wide network of receive locations

is necessary to build each corridor and help ensure global

distribution. The number of send and receive transactions

at an agent location can vary significantly due to such factors

as customer demographics around the location, immigration

patterns, the location’s class of trade, hours of operation,

length of time the location has been offering Western

Union services, regulatory limitations and competition.

Each of the nearly 300,000 agent locations in our agent

network is capable of providing one or more of our services;

however, not every location completes a transaction in a

given period. For example, as of December 31, 2006, more

than 85% of the combined locations in the United States,

Canada and Western Europe experienced money transfer

activity in the last 12 months. In the developing regions of

Asia and other areas where there are predominantly receive

locations, more than 65% of locations experienced money

transfer activity in the last 12 months. We periodically

review locations to determine whether they remain enabled

to perform money transfer transactions.

Consumer-to-consumer revenue growth in 2005 was

driven by growth in consumer-to-consumer transactions

and the acquisition of Vigo in October 2005. International

transaction growth benefited from growth in the United

States and European outbound businesses and strong

growth in China, India and the Philippines, including the

Philippines intra-country business. Consumer-to-consumer

revenue growth was also impacted by exchange rates. For

the year ended December 31, 2005, the exchange rates

between the euro and the United States dollar resulted in

a year-over-year negative impact to revenue of $1.4 million

compared to a benefit of $73.4 million in 2004, assuming

a constant exchange ratio (i.e., as if there were no change

in exchange rates from the same period in the

previous year) between the euro and the United States

dollar. Changes in exchange rates primarily impact

international revenue. On a euro-adjusted basis,

international revenue growth was 16% and 17% for the

years ended December 31, 2005 and 2004, respectively.

Growth in Mexico transactions for the year ended

December 31, 2005 was driven by growth in Western

Union branded transactions. The lower transaction

and revenue growth rates in domestic money transfer

for the year ended December 31, 2005 compared to 2004

are not attributable to any specific event.

The difference between international transaction

growth and revenue growth increased in 2005 compared

to 2004 primarily as a result of the negative currency

conversion impact of the euro compared to the benefit in

the prior year as noted above, which negatively impacted

revenue growth compared to the prior year. Intra-country

business is incremental to both transactions and revenue

but benefited transaction growth more than revenue growth.

Consumer-to-consumer pricing decreases, as a percentage

of our total revenue, were consistent from 2004 to 2005.