Western Union 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements 79

The unrealized losses as of December 31, 2006 and

2005 on the Company’s investments in state and municipal

obligations were the result of increases in interest rates

and were not related to credit quality. These unrealized

losses were deemed to be not other-than-temporary

because the Company has the ability and intent to hold

these investments until a recovery of fair value occurs,

which may be upon maturity.

All of the Company’s investments in preferred stock

are in government sponsored mortgage entities. Analyses

of the unrealized losses on preferred stock performed

during 2005 and 2004 indicated other-than-temporary

impairments on a portion of the Company’s investments,

resulting in impairment charges of $1.1 million and

$1.0 million for 2005 and 2004, respectively. There were

no charges recorded for other-than-temporary declines

in investment values in 2006.

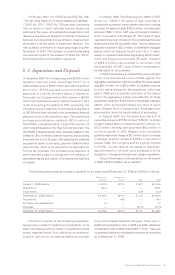

The following summarizes contractual maturities of state and municipal obligations as of December 31, 2006

(in millions):

Amortized Fair

Cost Value

Due within 1 year $ 33.5 $ 33.6

Due after 1 year through 5 years 70.3 71.0

Due after 5 years through 10 years 8.8 8.8

Due after 10 years 32.9 33.0

$145.5 $146.4

Preferred stock is not included above because the securities do not have fixed maturities. Actual maturities may

differ from contractual maturities because issuers may have the right to call or prepay the obligations.

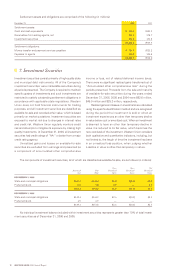

The following tables present the gross unrealized losses and fair value of Western Union’s investment securities

with unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated by investment category

and length of time that individual securities have been in a continuous unrealized loss position as of December 31, 2006

and 2005 (in millions):

Less than 12 Months Greater than 12 Months

Total

Unrealized Unrealized Total Unrealized

Fair Value Losses Fair Value Losses Fair Value Losses

DECEMBER 31, 2006

State and municipal obligations $ 7.7 $(0.1) $9.7 $ — $17.4 $(0.1)

$ 7.7 $(0.1) $9.7 $ — $17.4 $(0.1)

DECEMBER 31, 2005

State and municipal obligations $18.5 $(0.1) $ — $ — $18.5 $(0.1)

$18.5 $(0.1) $ — $ — $18.5 $(0.1)