Western Union 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Notes to Consolidated Financial Statements 89

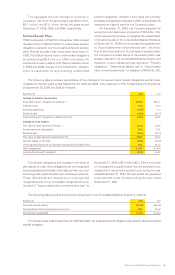

Revolving Credit Facility

On September 27, 2006, the Company entered into a

five-year unsecured revolving credit facility, which includes

a $1.5 billion revolving credit facility, a $250.0 million letter

of credit sub-facility and a $150.0 million swing line

sub-facility (the “Revolving Credit Facility”). The Revolving

Credit Facility contained certain covenants that limit or

restrict the ability of the Company and other significant

subsidiaries to incur debt, collateralize, sell, assign, transfer

or otherwise dispose of specified assets, or enter into

specified sale and leaseback transactions. The Company

was also required to maintain compliance with a

consolidated interest coverage ratio covenant. In

October 2006, the Company repaid the entire $100 million

amount due under the Revolving Credit Facility which had

been borrowed in connection with the spin-off from

First Data. As a result, there were no borrowings or

accrued interest under the Revolving Credit Facility as of

December 31, 2006.

Interest due under the Revolving Credit Facility is fixed

for the term of each borrowing and is payable according

to the terms of that borrowing. Generally, interest is

calculated using LIBOR plus an interest rate margin (19

basis points as of December 31, 2006). A facility fee is

also payable quarterly on the total facility, regardless of

usage (6 basis points as of December 31, 2006). The facility

fee percentage is determined based on our credit rating

assigned by Standard & Poor’s Ratings Services (“S&P”)

and/or Moody’s Investor Services, Inc. (“Moody’s”).

In addition, to the extent the aggregate outstanding

borrowings under the Revolving Credit Facility exceed

50% of the related aggregate commitments, a utilization

fee based upon such ratings is payable to the lenders on

the aggregate outstanding borrowings (5 basis points as

of December 31, 2006).

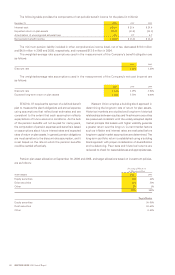

Notes

On September 29, 2006, the Company issued to First Data

$1.0 billion aggregate principal amount of unsecured notes

maturing on October 1, 2016 (the “2016 Notes”) in partial

consideration for the contribution by First Data to the

Company of its money transfer and consumer payments

businesses in connection with the spin-off. The 2016 Notes

were issued in reliance on exemptions from the registration

requirements of the Securities Act of 1933, as amended.

Immediately after the spin-off, First Data exchanged the

2016 Notes with two financial institutions for indebtedness

of First Data that the financial institutions held at that

time. The financial institutions then sold the 2016 Notes

in transactions exempt from the registration requirements

of the Securities Act of 1933. The Company did not receive

any of the proceeds from the subsequent sale of the

2016 Notes.

Interest on the 2016 Notes is payable semiannually

on April 1 and October 1 each year based on a fixed per

annum interest rate of 5.930%. The indenture governing

the 2016 Notes contains covenants that limit or restrict

the ability of the Company and other significant subsidiaries

to incur debt (in the case of significant subsidiaries),

collateralize, sell, assign, transfer or otherwise dispose

of specified assets, or enter into sale and leaseback

transactions. The Company may redeem the 2016 Notes

at any time prior to maturity at the applicable treasury rate

plus 20 basis points.

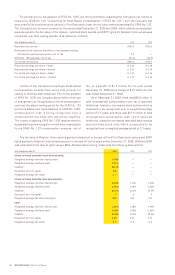

On November 17, 2006, the Company issued $2 billion

aggregate principal amount of the Company’s unsecured

fixed and floating rate notes, comprised of $500 million

aggregate principal amount of the Company’s Floating Rate

Notes due 2008 (the “Floating Rate Notes”), $1 billion

aggregate principal amount of 5.400% Notes due 2011

(the “2011 Notes”) and $500 million aggregate principal

amount of 6.200% Notes due 2036 (the “2036 Notes”).

The Floating Rate Notes, 2011 Notes, and 2036 Notes

were issued in reliance on exemptions from the registration

requirements of the Securities Act of 1933, as amended.

The Company used the net proceeds of the offering

of the 2011 Notes, the 2036 Notes, and the Floating Rate

Notes, together with the proceeds of approximately

$400 million of commercial paper the Company issued, to

repay the entire $2.4 billion in principal amount outstanding

under a bridge loan facility entered into by the Company’s

subsidiary FFMC, described below. This repayment resulted

in the release and termination of certain guarantees entered

into by FFMC in connection with the spin-off relating to

our 2016 Notes and the Revolving Credit Facility.

Interest with respect to the 2011 Notes and

2036 Notes is payable semiannually on May 17 and

November 17 each year based on fixed per annum interest

rates of 5.400% and 6.200%, respectively. Interest

with respect to the Floating Rate Notes is payable

quarterly in arrears on February 17, May 17, August 17,

and November 17 each year at a per annum rate equal to

the three month LIBOR plus 15 basis points, reset quarterly

(5.52% at December 31, 2006). The indenture governing

the 2011 Notes, 2036 Notes and Floating Rate Notes

contains covenants that limit or restrict the ability of the

Company and other significant subsidiaries to incur debt

(in the case of significant subsidiaries), collateralize, sell,

assign, transfer or otherwise dispose of specified assets,

or enter into sale and leaseback transactions. The Company

may redeem the 2011 Notes and the 2036 Notes at any

time prior to maturity at the applicable treasury rate plus

15 basis points and 25 basis points, respectively. The

Company may redeem the Floating Rate Notes at any time

on or after May 17, 2007 at a redemption price equal to

100% of the principal amount of the Floating Rate Notes

to be redeemed plus accrued interest thereon to the date

of redemption.

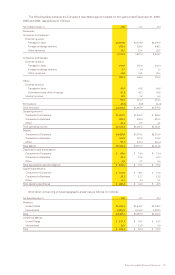

In connection with the issuance of the 2011 Notes,

the 2016 Notes, the 2036 Notes, and the Floating Rate

Notes, the Company filed a registration statement on Form

S-4 with the Securities and Exchange Commission on

December 22, 2006, which provided the holders of the

notes an offer to exchange their previously issued notes

for identical notes which have been registered. The

exchange offer closed on February 6, 2007.